Let’s say you’re trying to get rich quick. You might try to find the next meme stock or cryptocurrency to generate 100x returns.

Okay, scratch that, I was trying to get rich.

It was 2011 and I was buying Bitcoin when it was $300. Bitcoin is worth $50,000 today, so if I’d held onto it, we’d be basking in a success story here. But that’s not how it played out. I couldn’t handle the mood swings from anxiously checking the price every day, and within weeks of buying it for $300, I proudly locked in a $100 profit and celebrated selling at $400, unscathed from my first “investing” foray. I know I’m not the only one who can feel controlled by investments, a friend of mine who recently built a profitable bot for sports betting said:

“When I was in the thick of it, my mood was directly related to the performance of the bot on that day.”

What that experience taught me then, which I’m able to put into words a decade later, is that I thought I wanted to get rich quickly, but what I really wanted was a stress-free financial life. Soon after my Bitcoin shenanigans, I read a bunch of books on investing and I discovered how index funds can help you get rich slowly. When I learned that investing $10k a year for 30 years in an index fund would make you a millionaire, I was able to commit to the journey of building my wealth slowly, and I embarked on finding an investment choice that would last me a lifetime.

The investment of a lifetime

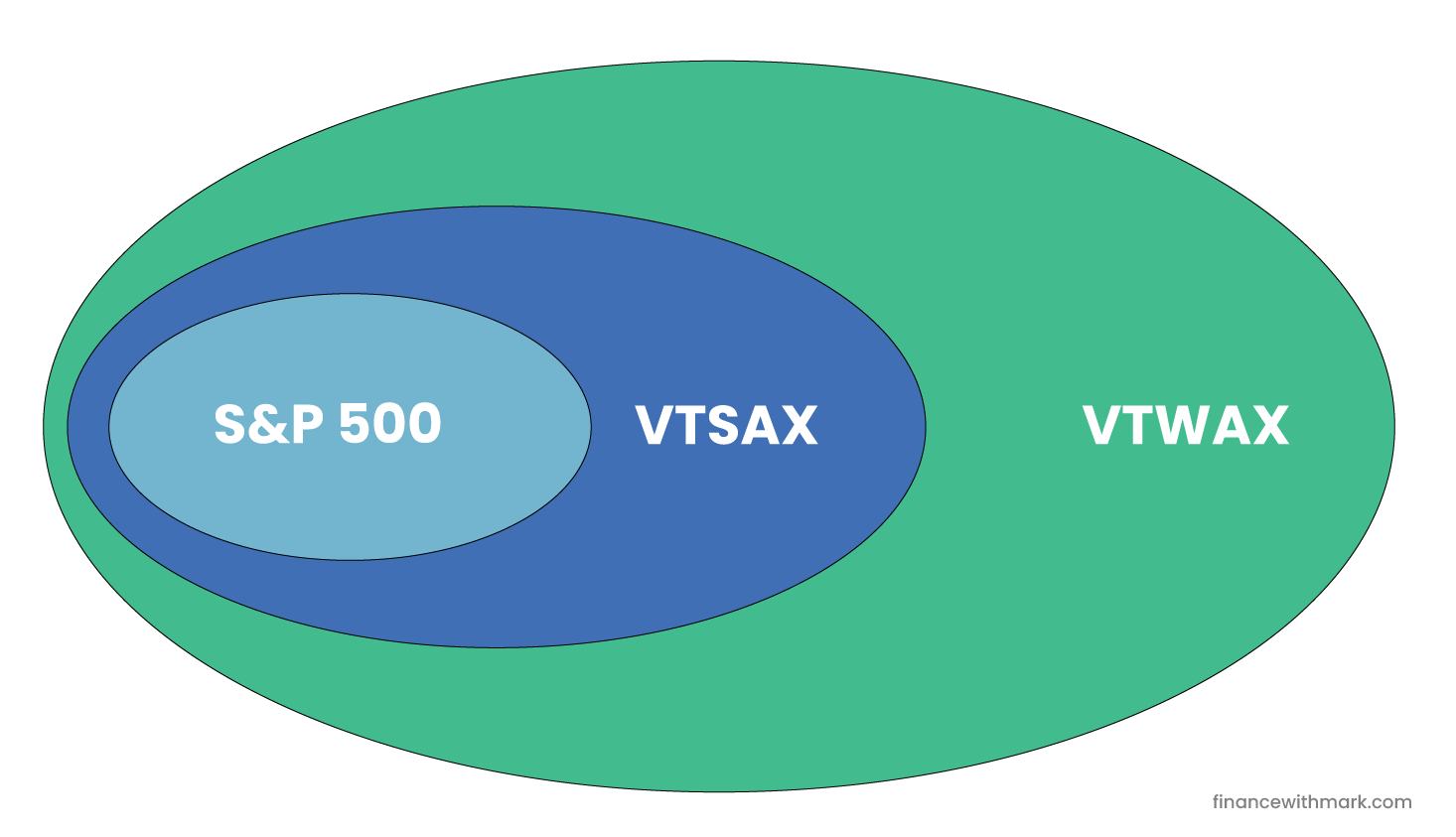

Many people decide they can’t outperform the market by picking individual stocks, or that it isn’t worth their time and energy to do so. and they go on to buy the S&P 500, the 500 largest companies in the US. It’s an investment that has fundamental long-term value. It’s not like crypto where the price is determined solely by others’ opinions. It’s not like property values that rely on housing demand increasing. You’re investing in businesses where people work to provide products and services, make a profit, and share a slice of the proceeds with you. But there’s one main downside with the S&P 500, it only includes 80% of the US stock market by size. What if the smaller companies end up doing better, wouldn’t you like to own them too?

So some people go further and invest in VTSAX, an index fund that holds every publicly traded company in the US, around 3,700 companies, and represents 100% of the US stock market by including small-cap companies too. In the same way that we don’t know which individual stocks will outperform, we don’t know that the largest companies will outperform, so we should buy the whole pie, and VTSAX does exactly that. Great.

Yet few people follow this reasoning to its logical conclusion. In the same way we don’t know which individual stocks will outperform, we also don’t know if the US stock market will outperform international stock markets, and so we should really buy an index fund that holds all companies from all stock markets. This is VTWAX, it’s made up of around 10,000 companies, the US currently makes up 64% of the fund, with the remaining 36% comprised of the remaining stock markets in the world like the UK, Germany, and Japan, in proportion to their size.

Note: If VTWAX isn’t available wherever you’re trying to buy it, the ETF equivalent VT might be. It’s almost identical and will do the job 🙂

Shouldn’t we bet on the US?

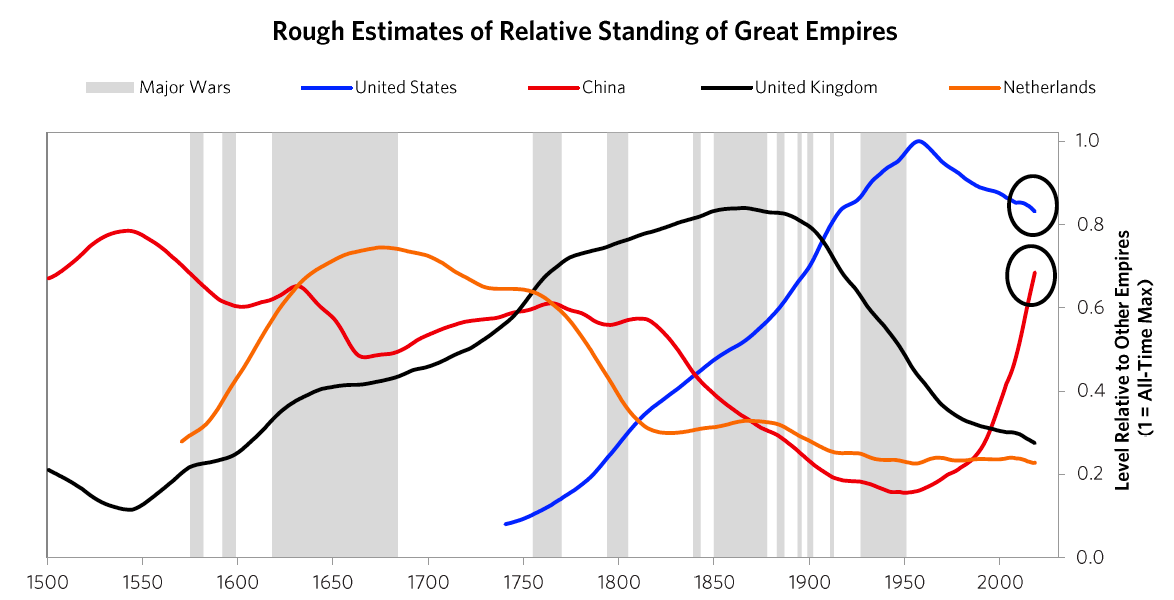

The US stock market has performed incredibly well in recent years. From 2010 to 2022, the US index gained 12% per year compared to just 4.4% from the international index[1]. Why wouldn’t we just own US stocks? I hear the concern. But there’s no law of nature that this performance will continue to exist indefinitely. Regression to the mean suggests otherwise.

Zoom out far enough and you’ll see the rise and fall of the Dutch Empire in the 1700’s and the British Empire in the 1800’s. The US’s global dominance is relatively recent in the scale of global economies.

Chapter 4: The Big Cycles of the Dutch and British Empires and Their Currencies

And there’s no promise that the US’s dominance will continue. Looking at many indicators, it looks like the US is actually on the decline, and China is on the rise.

If we look at the top 25 companies from the S&P 500 ten years ago, only ten are still in the top 25 today. In the same way that companies rise and fall, so do global economies. We don’t know what will happen, but change is guaranteed. Even JL Collins, a staunch supporter of VTSAX and the author of A Simple Path to Wealth conceded recently on The Money With Katie Show that while owning VTSAX will work for his generation, there’s nothing that says the US will be the best economy going forward, and that owning a global index fund would make sense for his daughter’s generation.

Adopting true indexing was beautifully captured in this Bogleheads post debating between investing in a US or a global index fund:

“Neither VSTAX nor VTWAX, obviously. VTTUX (Vanguard Total Universe Admiral) is what I bet all my networth on in the next 35 years. And before you ask, yes I’m 100% positive such fund that covers every company in the Universe will be offered by Vanguard in the near future since Earth shall fall and we will all move to Mars 🙂“

I’ll invest in VTTUX when humanity becomes a multi-planetary species. Until then, VTWAX is perfect.

A timeless choice

For someone who writes about personal finances, my investments are shockingly simple. Keep a large cash cushion. Buy and hold VTWAX. Understand myself so I don’t sell when the market drops. And buy some bonds when I get close to retirement to manage sequence of returns risk.

I’m free from day-to-day investing decisions. I’m free from year-to-year rebalancing. I’m not spending mental cycles of investing decisions, I’m allocating more bandwidth to life.

When you buy VTWAX, you’re betting on the collective productivity of the world, you’re buying something you can hold for the rest of your life. If that isn’t a timeless bet, I don’t know what is.