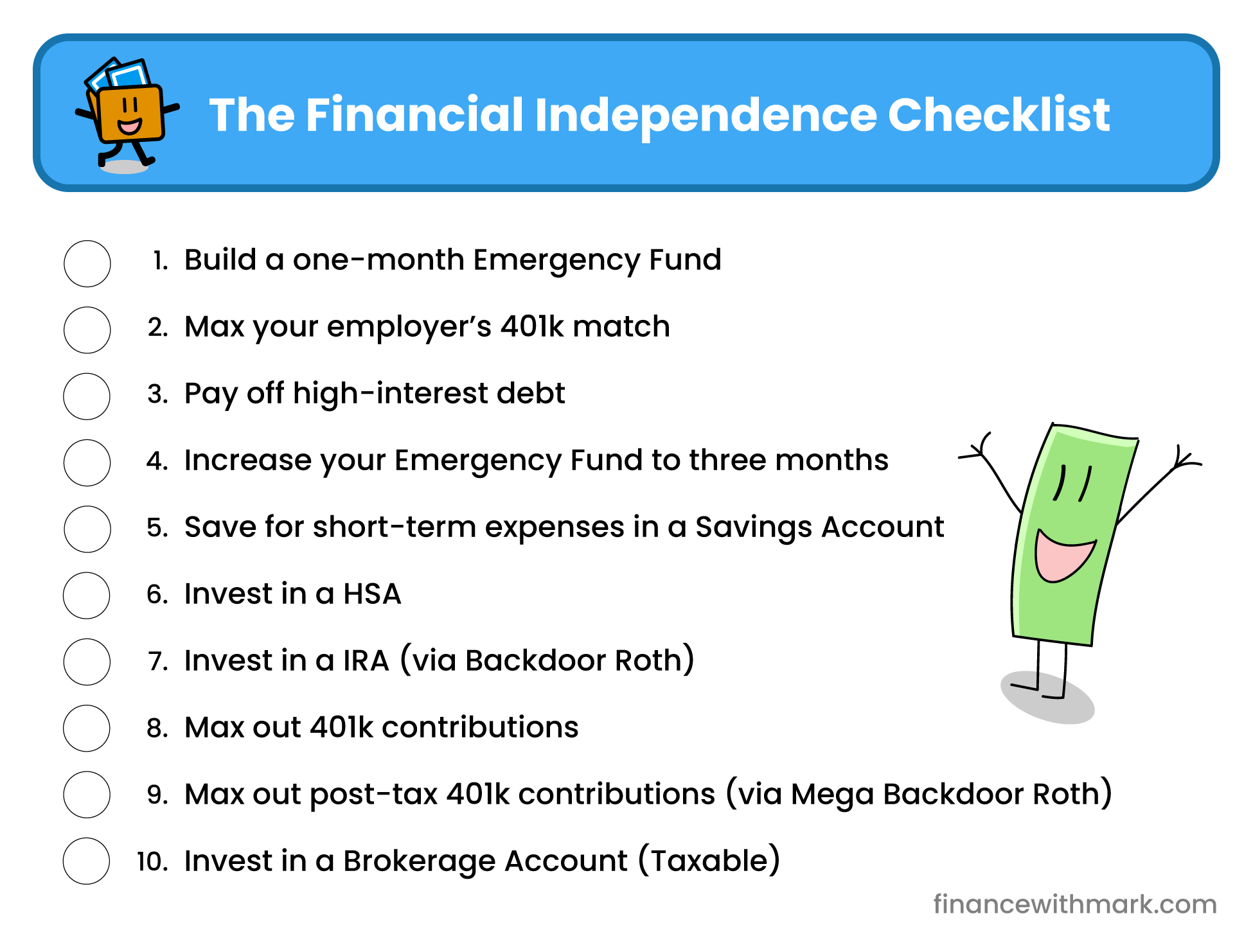

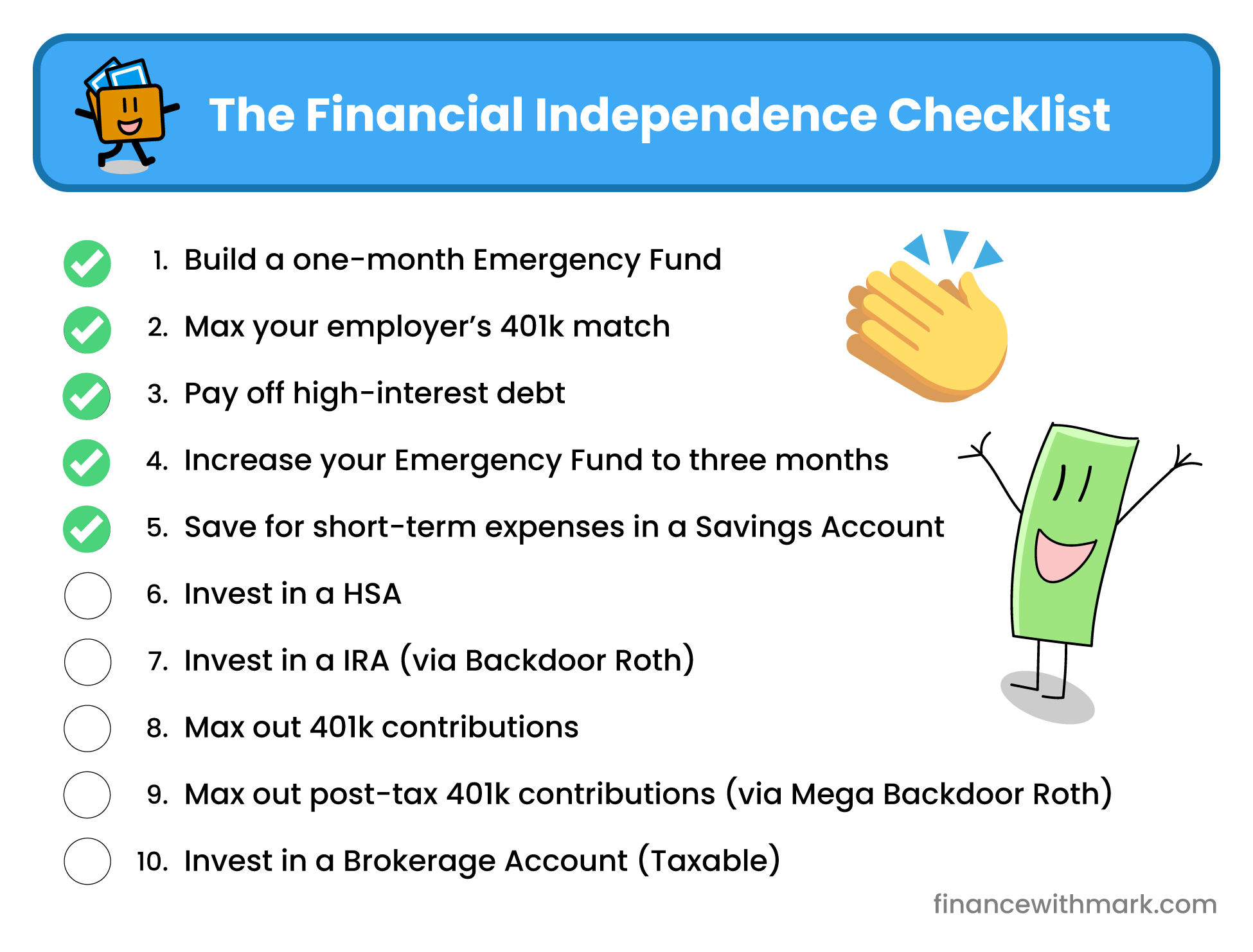

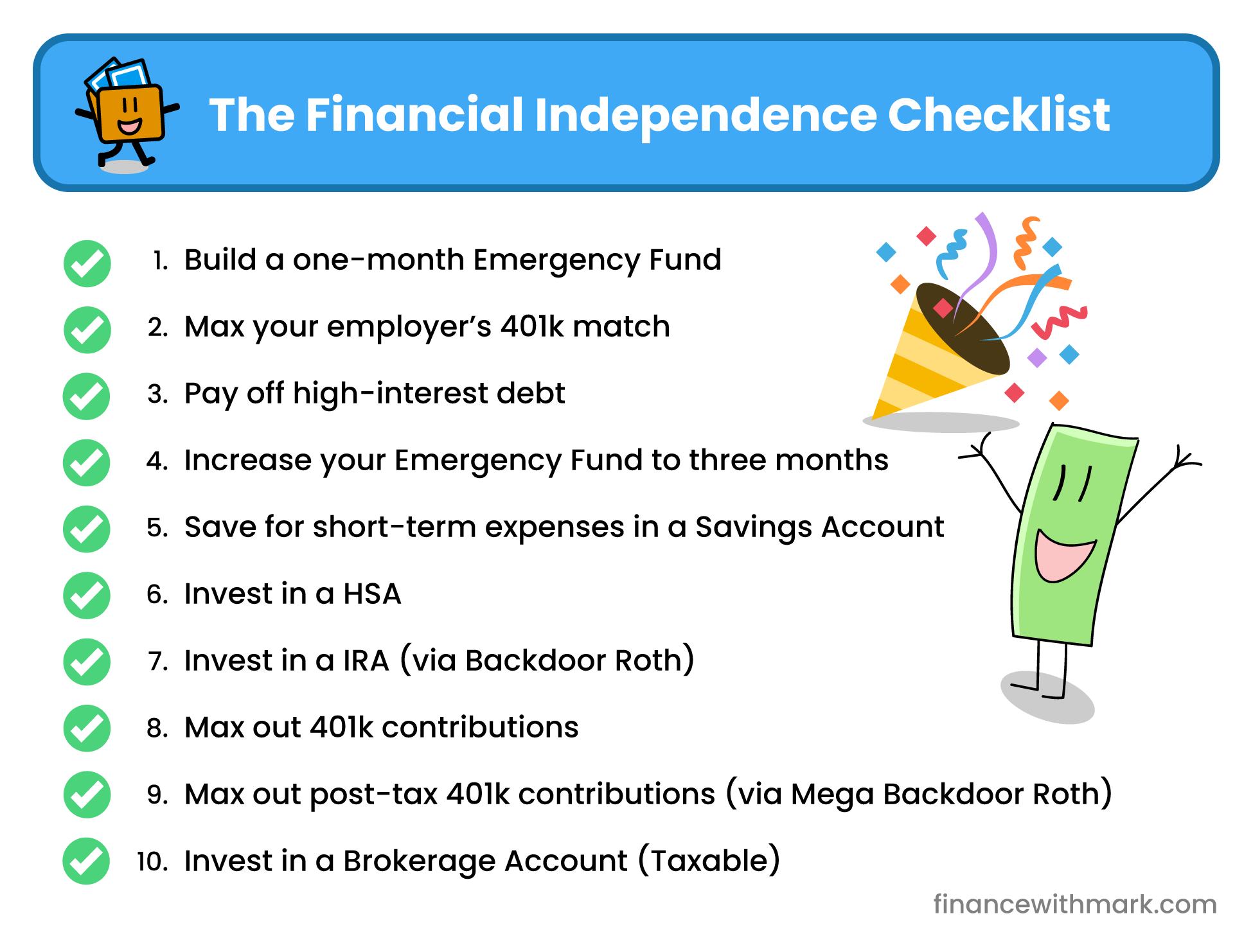

You don’t need to be an investment wizard to achieve your financial goals, you just need a straightforward checklist. Here it is:

This will take you from financial insecurity to financial independence.

How much you can benefit will depend on your income and the benefits your employer offers you, but say you were a Microsoft employee and could complete all of these steps which is definitely possible as I did it, you can earn just under $24,000 in a year from taking these steps (in addition to saving a bunch of money):

- Free money from your employer: $12,250 ($11,250 – 401k match, $1,000 – HSA match).

- Money saved by reducing taxes: $7,644 (from investing in a 401k, HSA, and IRA).

- Money earned from investments: $3,529 (based on a 6% average stock market return).

Even if your employer doesn’t offer a big 401k match or you can only afford to do a few of these steps, there’s still significant money you can earn and it’s the best investment you can make in your future to make your money work for you for years to come.

So are you ready? Let’s get started!

Note: This post assumes you’re saving money each month that is available to invest. If this isn’t the case, consider reviewing your income and expenses to identify areas to optimize, I like Money with Katie’s wealth planner (affiliate link), but there’s free alternatives too.

Contents

(to jump to sections if you’re coming back to this page)

- Emergency fund

- Employer 401k match

- High-interest debt

- Emergency fund

- Savings account

- HSA

- IRA

- Max 401k

- Max after-tax 401k

- Brokerage account

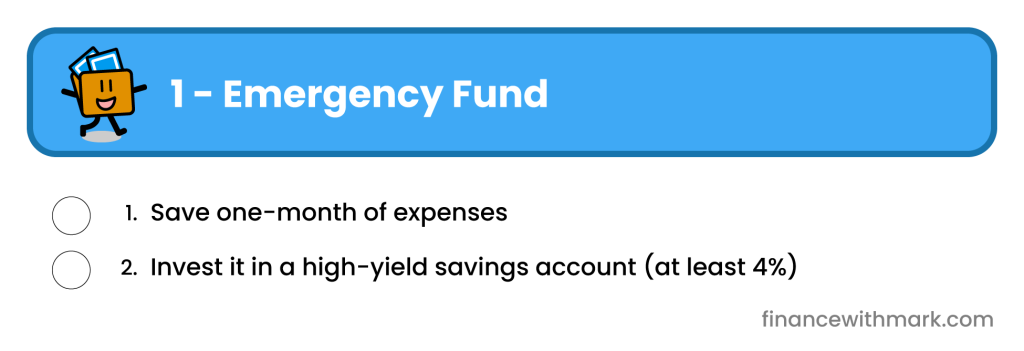

Step 1. Emergency fund

Life throws unexpected expenses our way all the time. The Emergency Fund is our trusty companion to protect us from the chaotic expenses of life

To get started, work out how much you spend each month, say $5,000. You should have at least one month saved in your emergency fund to cover emergency expenses.

You should also store your money in a high-interest savings account with at least 4% interest. With $5k saved, that’s $20 a month in interest, free dinner once a month for the rest of your life!

If you don’t have a savings account with a good interest rate, it’s worth investing an hour or two to make the switch, NerdWallet keeps track of the best deals here – Best High-Yield Online Savings Accounts.

Personally I use SoFi for my savings account. You can get 4.6% at SoFi (as of December 2023), along with an additional $275 when you open an account and set up a direct deposit. If you want to create an account, please consider using my referral link and I’ll earn some money from it too.

Checklist

Financial impact

$500 in year one.1$275 sign-up bonus and $225 a year in interest (assuming $5k saved at a 4.5% interest rate)

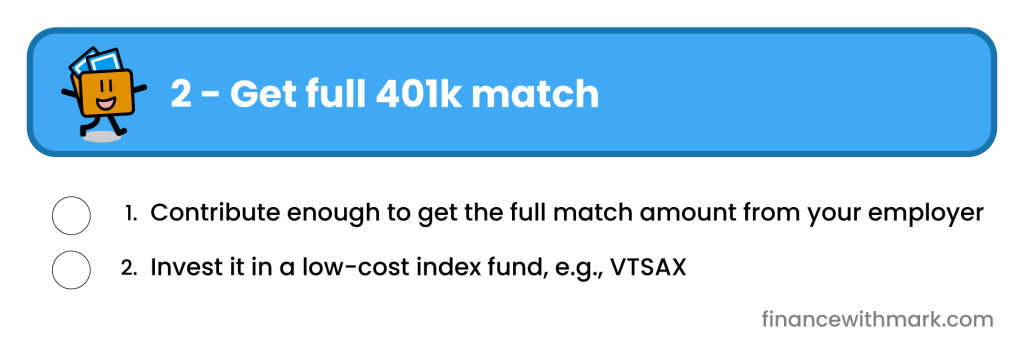

2. Max your employers 401(k) plan

Next up is to max your employer’s 401k plan. There’s not many times in life you get free money, but this really is the case. It’ll depend on your employer, it’s common to get $0.50 from your employer for every $1 up to a contribution limit, e.g. $6k. If this was your plan, you could get $3k in free money a year. The trade-off is you have to forgo having this money money today for money in the future – delayed gratification. But you aren’t locking away this money until you’re 55, contrary to popular opinion, it’s actually possible to access your 401k before age 55, see accessing your 401k early.

So dial up your contributions to your 401k to make sure you get the full employer match for the year. In 2023, if you’re at Microsoft that’s 50% of $22,500 – $11,250 of free money – amazing! Just make sure that you have enough money in each paycheck to cover your expenses before you dial it up.

While we’re at it, make sure it’s invested in a low-cost index fund so that you’re getting your fair share of the growth from all companies without the needless management fees associated with trying to outperform. VTSAX is one of the best choices but there’s plenty of alternatives.

Checklist

Financial impact

$11,2502if your employer matches at $0.50 on each $1 up to the 401(k) contribution limit of $22,500

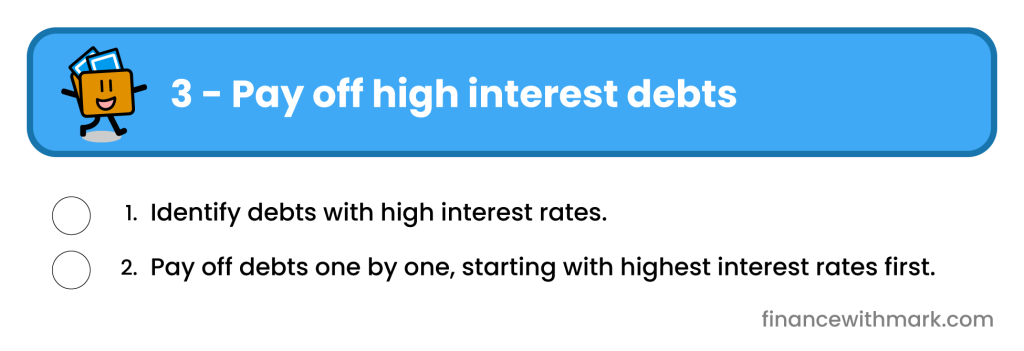

3. Pay off high-interest debt

As important as it is to invest, it’s equally as important to shield ourselves from expenses. It pays to invert the problem, the way to get rich is to first prevent yourself from getting poor.

“Tell me where I’m going to die and I’ll never go there”

Charlie Munger

Debt is the opposite of an investment, it continually pulls money from us, reducing our worth over time. Low-interest debt can actually be a good thing, if you have a 2.6% car loan like I do from 2020, then investing the money instead of paying off the loan enables you to profit as the stock market has a higher return, 7% historically. But high-interest debt is just going to hinder your progress to financial independence. As a rule of thumb, if it’s over 5% I would pay it off.

Checklist

Financial impact

The amount of debt you have * the different in interest rates between your debts and your savings account.

If you have $10k in debt that has a 7.5% interest rate, and you have a 4.5% interest rate in your savings account, you save $300 by paying off the debt.

4. Increase your Emergency Fund to three months

Ah, our trusty sidekick the emergency fund is back.

Once you’ve got rid of any high-interest debts that were significantly hampering your progress to financial independence, it’s now a great idea to build a bigger buffer with your emergency fund – the last thing you want is to lose your job and be unable to pay off your credit card expenses because you run out of your safety net.

Building three months of living expenses will take a little longer. You could choose to just focus on discretionary expenses, maybe you stop eating out if you lose your job and so you don’t need $15k (3 x $5k) to last three months. And ultimately three months is just a guide. The purpose of the emergency fund is to protect you from going into debt. Ask yourself how many months would it take you to find another job to cover your expenses if you were laid off. How would you fund your expenses during this time? If you have other safety nets such as the ability to borrow money from family or friends, or secondary income streams you could spin up such as tutoring high-school students when you’re unemployed, then maybe you don’t need such a large emergency fund. Either way, think about how much you need, set this goal, and reach it before moving on to what’s next.

Checklist

Financial impact

$450 3$45 for every $1k you save, given savings account with 4.5% interest

5. Save for short-term expenses in a Savings Account

This might feel redundant, you’ve just saved three months of expenses. But if you’re aware of short-term expenses coming up, putting $5k down on a new car, putting $100k down on a house, whatever it is, you need readily available cash to fund this. Assess the expenses you’re aware of that are coming up, and save for them. Let’s say you know you’ll be buying a new car but it’s likely a couple of years from now, maybe you decide to invest your additional cash now and reduce your investments in 18 months to build up the extra cash for the car. That’s great, just be mindful of it.

The reason for this is that the stock market is bumpy, there’s no guarantees that $1,000 that you put in the stock market today is worth $1,100 a year from now. It could be $1,800 or $500. We need to protect ourselves from unforced errors, and being forced to withdraw investments at a loss because we were too eager and invested too much initially is one of those errors we need to guard ourselves from.

Checklist

Financial impact

$450 4$45 for every $1k you save

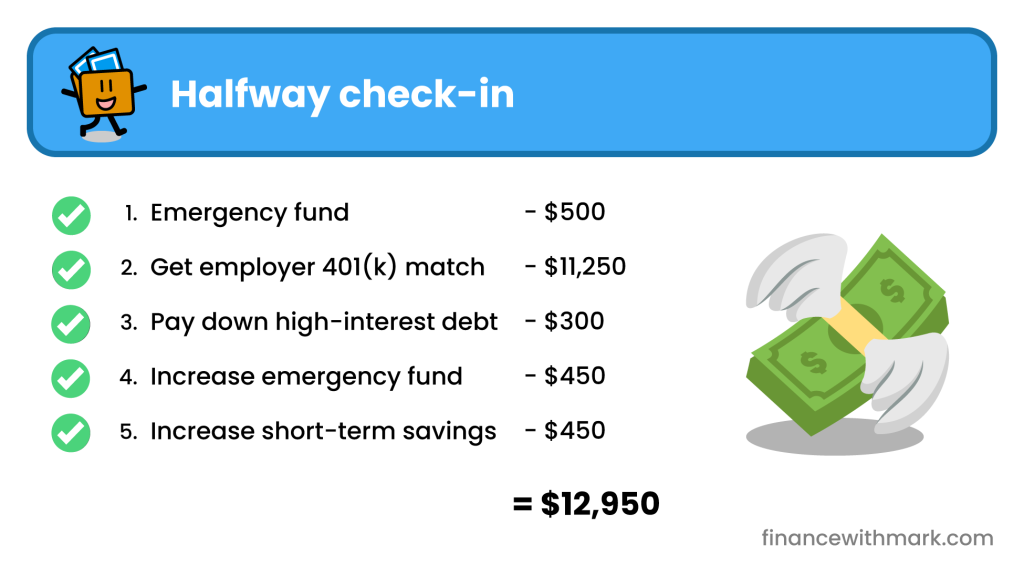

Halfway check-in

We’re halfway! 👏 Look at that progress! 🎊

This translates to a projected extra $12,950 in the process. Of course it’ll vary by your situation, feel free to take the time to work out just how much you’ve earned from making these changes. Congrats!

Reflection

One of the things that surprised me with investing is how much of it is playing a good defensive game. We’ve only invested once in these first five steps, and that’s in our workplace 401(k) – hardly exciting.

But it’s also something that gives me great comfort when it comes to investing. It’s not intelligence or risk-taking that gets us to financial independence, it’s exercising good judgment. Most investors would have much better outcomes if they acted like their investment decisions were impacting their parents and grandparents’ investment accounts instead of their own.

With that said, let’s move on and do some investing!

6. Invest in an HSA

HSA’s are mind-blowing investment vehicles, I couldn’t believe it when I first learned about them. They allow you to contribute tax-free, compound tax-free, and withdraw tax-free – the only true way to avoid taxes entirely while investing.

HSA’s come with a downside which is you need to be enrolled in a High Deductible plan with your employed to be eligible to contribute to an HSA, and the details of your health care plan and how you use it will make all the difference.

If you have an excellent health care plan where the out-of-pocket max is limited to say $2,500 or so and you’re unlikely to be making claims on your plan, it’s worth going for it, especially as your employer will likely contribute to your HSA too (Microsoft contributed around $1,350) so this free money will offset any costs you have. Then your money is free to compound tax-free for decades, significantly improving your returns, and you get to withdraw it tax free too!

But if you have a less than excellent health care plan where the out-of-pocket max is more like $4,000 and you’re likely to be making claims on your plan, it’s not worth it, especially if your employer is contributing less to your HSA to offset your costs.

You’ll have to sit down and run the numbers. But if you have a great high deductible plan and are unlikely to be making claims through the plan, open a HSA and invest the $3,850 each year, again, in a low-cost index fund like VTSAX.

And another amazing benefit is you can withdraw money from your HSA for qualified medical expenses at any time, which means you could pay your medical bills with cash, save your receipt, and withdraw the money decades later, leaving a higher balance in the account to compound tax free. Better still, never withdraw from the HSA for medical expenses and just wait until you’re 65, where you can then withdraw for any reason, to fund your living expenses in retirement.

7. Invest in an IRA

Okay, this is where things get a bit technical, but stick with me!

If you’re not familiar, an IRA is another account that allows you to invest $6,500 in a tax-advantaged way. Whenever you hear the term “tax-advantaged”, think “opportunity to earn more money” – as investing in an account that gets you a 20% tax-cut is the equivalent of earning 25% income on the amount of money you’re investing. More details in the IRA article.

An IRA is definitely something you should take advantage of. But for high-income earners, it can appear that it’s not possible to invest in IRAs because of the following facts:

- If you’re earning over $83k, you can’t get a tax deduction for contributing to a Traditional IRA

- (there’s no reason to invest without the tax benefit)

- If you’re earning over $153k a year, you can’t contribute to a Roth IRA

- (you can’t invest even if you wanted to).

Fortunately, that isn’t true. There is a mechanism known as a rollover that enables a process known as the Backdoor Roth IRA that enables high-income earners to still contribute to an IRA. It goes like this:

- Contribute to a Traditional IRA (as cash)

- Complete a Roth conversion (and then invest it)

This enables you to get money into a Roth IRA while bypassing the income limits of a Roth IRA.

It’s well worth taking advantage of the Backdoor Roth IRA as it enables you to invest $6,500 a year without being taxed on gains and withdrawals, unlike a taxable account. You can withdraw your contributions without any tax or penalty five years after your conversion, so it’s easier to access than 401(k). And you can withdraw your earnings tax and penalty free after age 59.5 and five years after your first contribution to any Roth IRA.

Before you go ahead with the Backdoor Roth IRA though, be very careful that you’re not impacted by the pro-rata rule as that’ll cause you to owe taxes on the $6,500 you convert in the process. More details in the Backdoor Roth IRA article.

8. Max out 401(k) contributions

We prioritized investing in the IRA before maxing out the 401k contributions beyond your employer’s match because you’ll often have better investment choices and you can access your money from Roth IRA more easily than a 401(k) – although it’s still possible to access your 401(k) early.

Now that you’ve contributed to an IRA, it’s time to max our your 401(k) contributions. Simply crank the dial again after making sure you have enough money across your savings account and paychecks to cover your expenses.

9. Max out after-tax 401(k) contributions

This is an ultimate next step. Known as the Mega Backdoor Roth, this is a mechanism that allows you to invest an extra $43,500 in a tax advantaged way each year. Yes, you read that right, saving taxes on $43,500!

Of course, you need to be earning significant money, and saving a sizable portion of it to to get to this stage in the checklist and still have money to invest. But if you do, this is an amazing way to supercharge your financial goals.

It’s a little involved, enough so that I’ll just link out to the Mega Backdoor Roth post that I’ve put together on it.

10. Invest in a brokerage account

Finally we have investing in a brokerage account. And I can feel the shock from you. You likely had investments in a brokerage account before you completed half of the steps above, whether it was Vanguard, Wells Fargo, Fidelity, or just a Robinhood trading account.

It’s great that you started with investing, and a brokerage account is easily accessible and gives you access to thousands of funds. But brokerage accounts come with none of the tax benefits of the accounts above, which is a big deal when it comes to growing wealth over time:

- Contributions are taxed ❌

- Gains are taxed ❌

- Withdrawals are taxed ❌

It’s gains being taxed, the second item, that many people don’t realize.

If you bought index funds in a Vanguard brokerage account, even if you follow the buy and hold strategy, never selling your funds, and reinvesting the dividends, you will still owe taxes each year on the gains in your funds. This shows up in Form 1099-DIV each year. It’s easy to miss it when we’re powering through TurboTax, but these fees are there, they’re a drag on your net worth year over year, and they’re something we should aim to avoid.

This is why it’s so important to maximize all other accounts first, and only use Brokerage accounts for excess money or money we’re sure we need earlier access to than what’s possible through the other tax advantaged accounts.

Completed

How’s your checklist looking? If you’ve made it all the way through and completed each step, then you’re looking like this!

This isn’t all that’s needed to get to financial independence, but you’ve set up such a solid foundation for your future. The key thing is to manage your expenses, continue to make use of the tax-advantaged accounts each year, and don’t make any rash decisions when the stock market drops (as it inevitably will).

Congratulations on investing in your financial future, your future self will thank you.

If you have any questions, if there’s anything I could better explain, or if you’ve seen any mistakes, please get in touch, I’d love to chat: mark@financewithmark.com

And if you’re looking for even more ways to earn money, check out my post Extra money for you and me with referral links to services I use to improve my finances.