When I was training for a half-ironman, I spent most of my time training on the bike.

Triathlons include swimming and running of course, but the bike leg makes up 56 miles of the 70.3-mile race and also makes up about two-thirds of the elapsed time, so given that I prioritized my bike fitness. I put in 4-hour training rides to build my aerobic base. I planned short, hard sessions with intervals to increase my power. I focused on time in the saddle instead of time on feet or yards in the pool. As the weeks passed, I saw my average power increase, I felt much fitter, and I was confident I’d drop at least 15 minutes on my previous time.

But while I’d focused on improving my fitness on the bike, I hadn’t considered a factor that was almost as important. Aerodynamics. While many people ride bikes on regular handlebars, once you enter the world of triathlon there’s another type of set-up; instead of using handlebars, you use aero bars. Aero bars get you to stretch your body out in front of you, aggressively tucking to minimize air resistance and make you ride faster through the air in front of you. But you constrain yourself in new ways. Many aero bars don’t provide access to shifting gears or brakes, so you can only tuck into them when the road is clear ahead. You need to research and buy clip-on aero bars to attach to your existing bike, or buy a new bike altogether. And you need to train yourself to ride efficiently in this new setup.

It’s an extra hassle, but it’s one of the biggest performance gains you can get. While I’d dropped 15 minutes by diligently improving my fitness, I could drop another 10 minutes by buying aero bars to clip onto my bike. Aero is so important that the main challenge for professional triathletes isn’t putting out great power, it’s maintaining an aero position while putting out this power. I was left with the decision – do I buy aero bars to save some time?

I tell this story as an analogy to investing.

If you’re investing in index funds, you’re already ahead of the game. Ahead of people picking individual stocks, far ahead of people who haven’t learned about investing and have their savings in cash. You’ve put time in the saddle to improve your fitness and get better results.

But if you haven’t thought about which accounts you’re holding your investments in, you’re not riding in an aero position. You might be encountering serious headwinds in the form of taxes – a continual drag on your returns for your investing lifetime. Thinking about which accounts to hold your investments in will pay dividends. Actually, it’ll stop you from losing those dividends to taxes.

Brokerage accounts

When you hear brokerage account, think taxes. A brokerage account is also known as a taxable account, and there’s a good reason for that.

You likely have some investments in a brokerage account already, whether it’s Vanguard, Wells Fargo, or even a Robinhood account. By holding investments in this account, you’re subjecting yourself to taxes every year, as you’ll owe taxes on any dividends they pay out. This is true even if your fund is set up to reinvest the dividends, even if you don’t sell your investments each year, and even if you’ve made a loss on paper in that tax year. You might not be aware of this, it surprised me when I found out, and even if you’re aware, the long-term impact of these taxes might surprise you.

I’ll give you a glimpse into my finances to show you an example.

In 2022, I had $34,236 in my brokerage account in Vanguard. I held two funds, VTSAX and VTWAX, and these funds together paid out $1,037 in dividends. As I was holding these funds in my brokerage account, I owed taxes on these dividends. This is even though I reinvested the dividends and didn’t even sell the investment. You’re forced to “realize” these gains every year and pay taxes out of your own pocket – thank you, IRS.

There are two types of dividends, and they’re each taxed differently:

- Qualified dividends – taxed at a lower rate, 15% for most people.

- Ordinary dividends – taxed at your marginal rate, 24% or 32% for most tech employees.

For my $1,037 in dividends, I owed a total of $166 in taxes (16%. Qualified dividends made up 93%).

It’s easy to be unaware of these taxes on dividends for investments in your brokerage account, especially if you file your tax returns with TurboTax where it imports statements and calculates the returns for you. If you want to check it for yourself, look at Form 1099-DIV from your brokerage account, section 1a and 1b, and your main tax return Form 1040, section 3a and 3b.

The impact of taxes

So what’s the long-term impact of taxes on your brokerage account?

Let’s imagine you haven’t yet maxed out your 401(k), and we have two scenarios, one where you decide to max out your 401(k), and another where you get the money in your paycheck and later invest it in a brokerage account instead.

Scenario 1: Investing $10k per year in a brokerage account.

Scenario 2: Investing $10k per year into a 401(k).

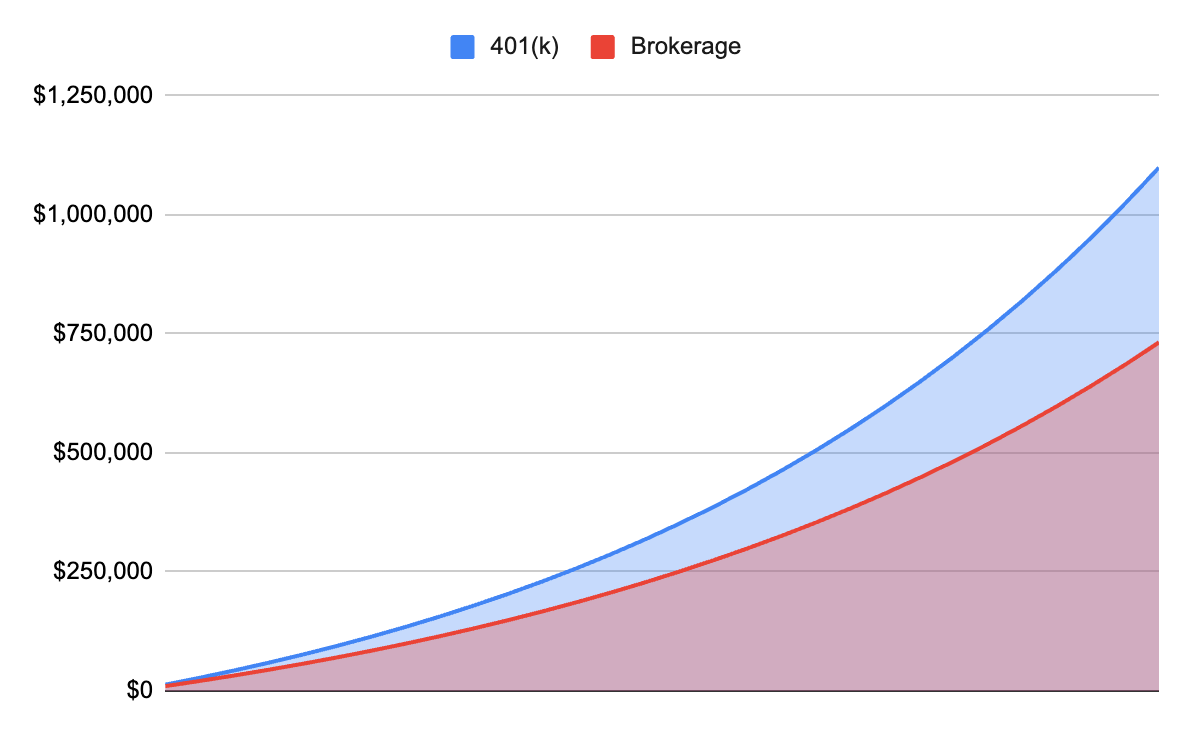

A 401(k) will outperform a brokerage account due to the tax advantages. But how much does it outperform over 30 years? What’s your guess? 20%? 30%?

Over 30 years, the 401(k) outperforms the brokerage account by more than 50%. You’ll have $1.1 million instead of $730k, an extra $370k. You might have noticed that this extra $370k is more than the total amount you contributed over this same period – minimizing taxes is that powerful.

Let’s break down how the 401(k) outperforms the brokerage account.

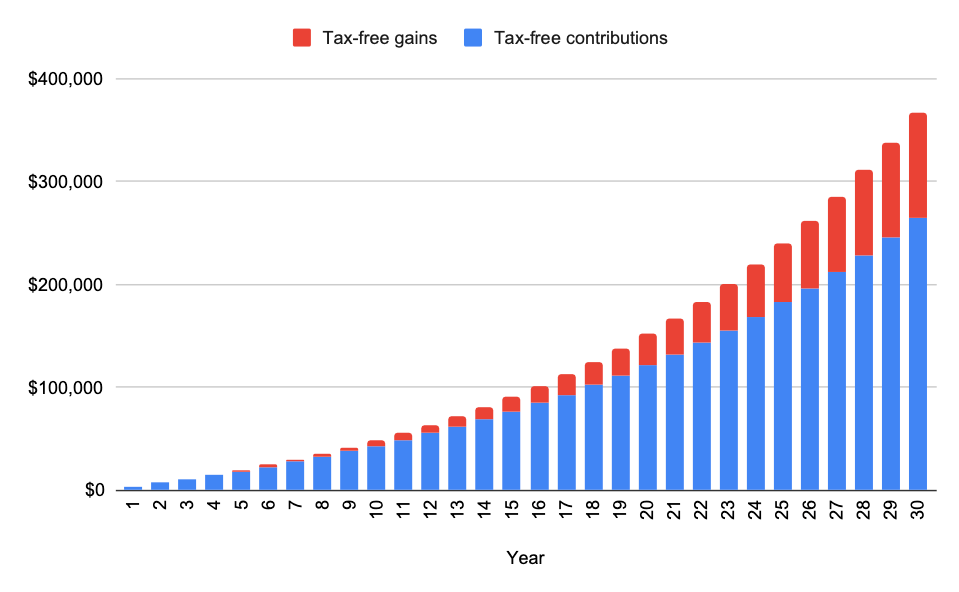

1. Tax-free contributions

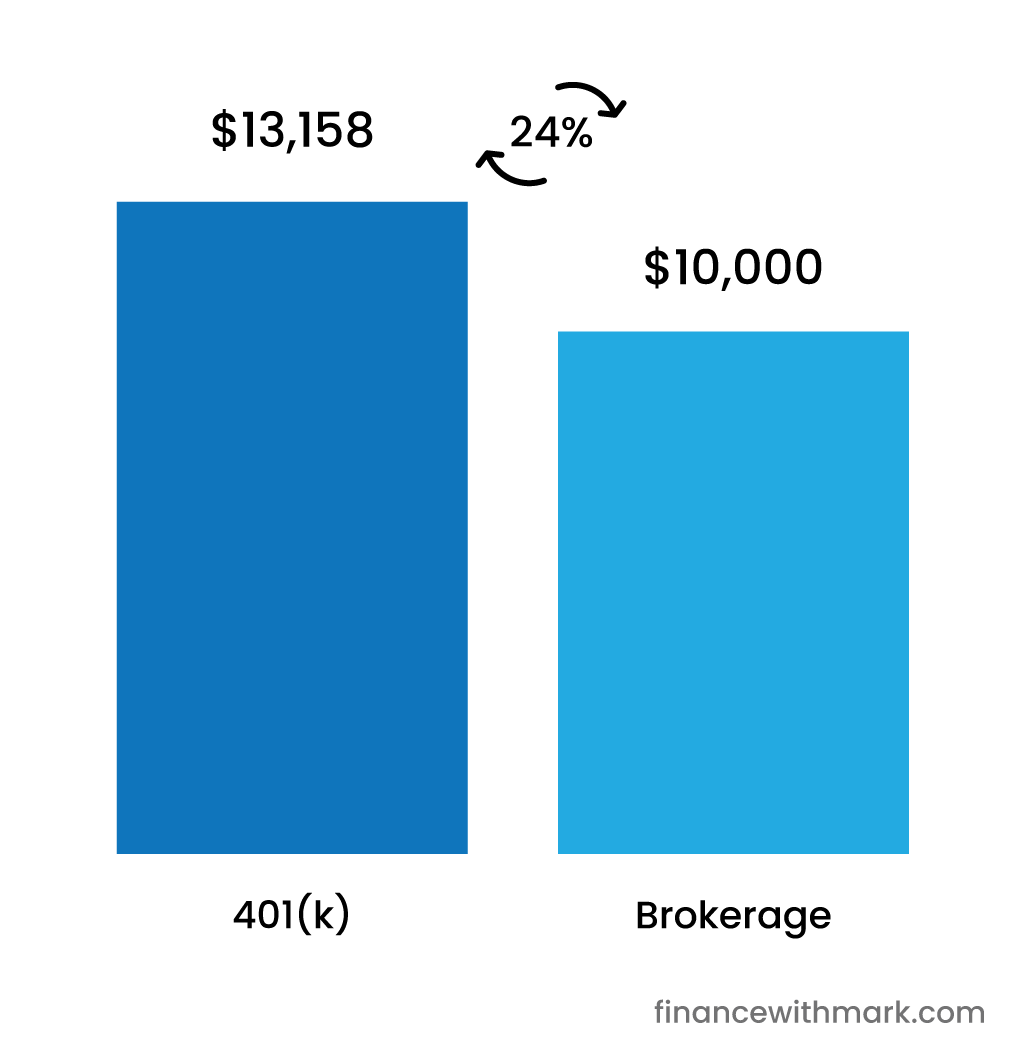

Firstly, the 401(k) outperforms the brokerage account due to tax-free contributions.

A $10,000 contribution to your brokerage account is equivalent to a $13,158 contribution to your 401(k)1assuming a marginal rate of 24%. Because your 401(k) contributions are before tax, what you would have paid in tax goes to investments instead.

And this extra $3,158 a year compounds, too.

Over 30 years, avoiding taxes on contributions earns us an extra $263k.

2. Tax-free gains

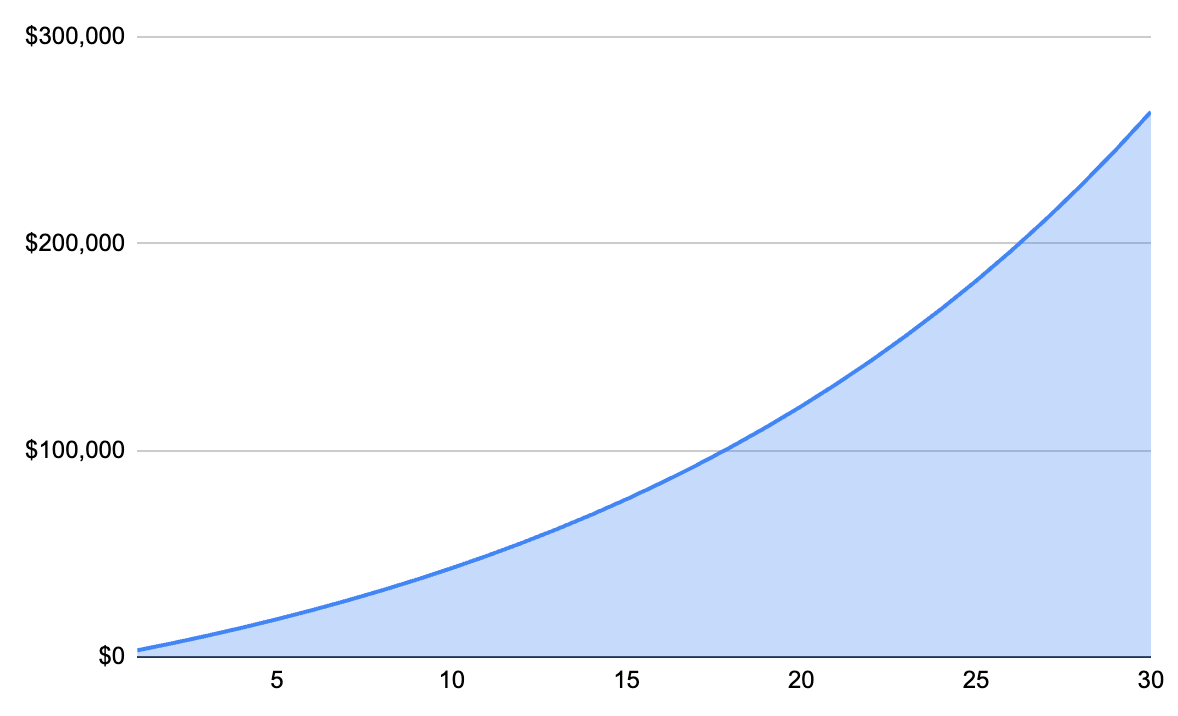

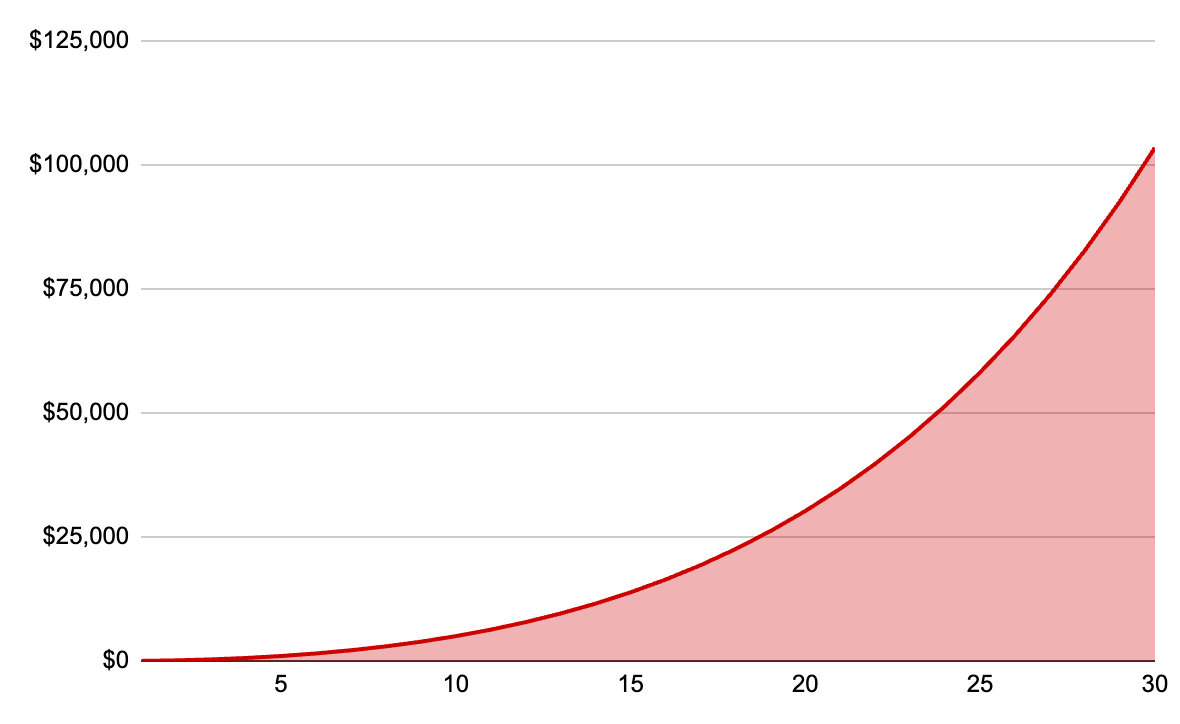

Secondly, the 401(k) outperforms the brokerage account due to tax-free gains, this is from avoiding taxes on the dividends you receive.

For VTWAX, my favorite investment, half of the gains come from dividends (profits that are paid out quarterly), with the other half coming from capital appreciation (an increase in the stock price).

When you hold VTWAX in a brokerage account, as half of the gains come from dividends, you’re paying taxes on half of the gains every year, even if you’re reinvesting the dividends and not selling your investment. In effect, your 6% return from VTWAX drops to 5.3% after taxes.

This isn’t a big difference in the first few years, a couple of hundred dollars of dividends in taxes, but before long it becomes a significant drag on your returns, a major headwind you should try to avoid.

Over 30 years, paying taxes on dividends held in a brokerage loses us $103k compared to holding the fund in a 401(k) where it can grow tax-free.

Recap

To recap, if you’re investing $10k a year for 30 years in a 401(k) instead of a brokerage account, you’ll end up with $1.1 million instead of $730k, an extra $370k, 50% more money.

While avoiding tax on dividends doesn’t make much difference initially, after 30 years, almost a third of the extra money is due to tax-free gains, with the remaining two-thirds from tax-free contributions.

ℹ️ A note on withdrawals

It’s worth noting that you’ll still taxes when withdrawing from the 401(k), as we’ve just deferred taxes, but as you’re likely in a lower income bracket in retirement, you’re trading off paying something like a 24% marginal tax rate on contributions, to a 10% effective tax rate when withdrawing, saving the difference between these two in taxes.

Next steps

So what should we do with this information?

Saving an extra 50% on top of your savings is huge and shouldn’t be understated, so firstly, make sure you’re taking advantage of all the tax-advantaged accounts available to you. The Financial Independence Checklist is a great way to check you’re not missing anything.

But is holding investments in a brokerage account a bad idea? Not necessarily. If I’d implemented the Mega Backdoor Roth as soon as I started working in the US, maybe I wouldn’t have money in a brokerage account. But is paying $166 in taxes to hold $34k in a brokerage account a bad deal? I wouldn’t say so. Having these investments in a brokerage account gives me peace of mind that I have more money beyond my emergency fund readily accessible. Is it the most optimized allocation of money? No. Do I feel comfortable about it? Absolutely.

I’ll finish off the story I introduced at the start about aero bars for triathlons. While having aero bars would’ve gotten me a faster time on the bike, dropping me 10 minutes and guaranteeing better results – I didn’t buy the aero bars. I wanted a faster time, but what was fulfilling to me was improving my fitness on the bike, not buying extra gear to drop my time. If it came down to it, I’d rather be one of the fittest people running a cheap setup than one of the slowest people running a fancy setup.

It’s different for investing. I enjoy utilizing tax-advantaged accounts to reduce the drag of taxes and grow my wealth effectively. There’s something deeply satisfying about putting my money to the most efficient use. But that isn’t to say I feel forced to use every last optimization. I’ll always keep enough cash available so I’m anti-fragile. There’s nothing smart about optimizing your long-term wealth to the point it causes cash flow problems. Get your emergency fund and short-term savings in place before you put your head down with tax-advantaged accounts.

We have a lifetime of investing ahead of us. The strategy that keeps us in the game is the one that wins out. We don’t always have to ride on aero bars.

Get in touch

If you have any questions or comments, I’d love to hear them, please drop me an email at mark@financewithmark.com

And if you want to play around with the numbers to see how a 401(k) compares to a brokerage in your tax bracket, check out this spreadsheet: 401(k) vs. brokerage account