Please note, if you buy a book through these affiliate links I’ll earn a commission through the Amazon associate program. Thanks for helping to support this blog.

My top recommended books

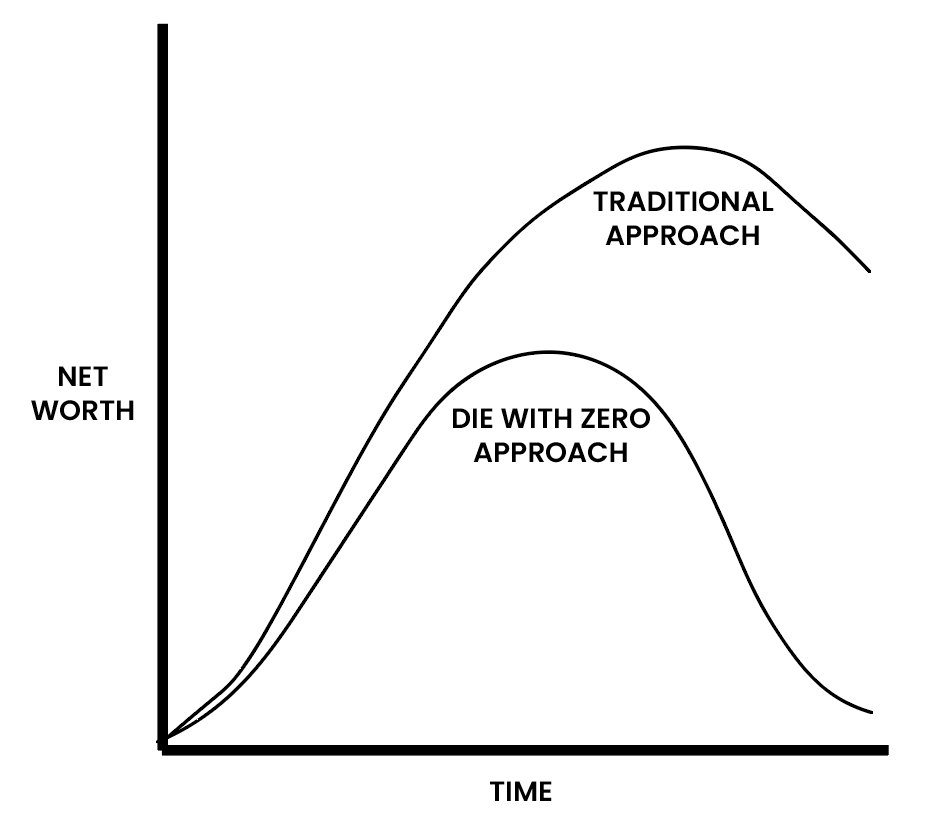

Die With Zero

Die With Zero gave me a new perspective on the FIRE movement. I was saving too aggressively in my 20’s, when I should have been spending on experiences that wouldn’t be possible in my 60’s and beyond. If it wasn’t for the learnings from this book, would likely have fallen into the trap of delaying gratification too much, saving too much for retirement, and wasting too many years at work as a result.

Your Money or Your Life

Your Money or Your Life helped me consider the true cost of work, when you account for time spent commuting, time spent thinking about work, additional money spent on takeout meals due to work stress, and considering how much I keep. Earning $50/hr actually means taking home $25/hr if you have a 50% savings rate, and once I evaluated buying things in the world through this lens, I naturally found myself spending far less.

If You Can

A 30-minute booklet that I think every new employee should get to set themselves up for financial success. Implementing this easy to read advice will almost certainly guarantee the reader a comfortable retirement.

The Little Book of Common Sense Investing

I read this when my money and my parents money was still invested in actively managed funds with 2%+ fees. I’d just learned about index funds with 0.25% fees and below and wanted to make the jump to index funds but needed to gain confidence in this strategy. This book is the strongest argument for why picking stocks fails, it details how there’s a 5% chance you can actually outperform index funds over a 20-year period, and shows for good why index funds are the best way to guarantee your fair share of stock market returns.

The Simple Path to Wealth

I read this years after getting into FIRE, but JL Collins simple and straightforward advice, written through the perspective of letters to his daughter, were a great recap of the FIRE fundamentals in an easy to read, pleasurable way.

The Psychology of Money

The Psychology of Money is one of my favorite books about investing. Morgan Housel shows how so much of investing is counter intuitive and how having the right psychology makeup is far more important for becoming a successful investor than for having the right knowledge.

My favorite story is the comparison between two individuals with very different educations. Ronald Read, who fixed cars at a gas station for 25 years and swept floors at JCPenny for 17 years, when he passed away aged 92, he was worth $8 million, donating $6 million to his local hospital and library. From janitor to philanthropist. Compare him to Richard Fuscone, a Harvard-educated Merrill Lynch executive with an MBA, worth tens of millions of dollars, who retired in his 40’s to focus on “philanthropy”. He overextended himself financially through an 18,000-square foot home with 11 bathrooms that cost more than $90k a month to maintain, and ultimately declared bankruptcy. This story tells us everything we need to know about personal finance, it’s not our intelligence that determines our results, it’s our behavior. It’s good judgment.

I feel fortunate that the principles of successful investing naturally fit with my personality traits, such as being focused on long-term results over quick wins, and not rushing into risky investments because I don’t compare my results to others or worry about missing out. I like using this blog to share these messages to try and help people on the right path to financial success.

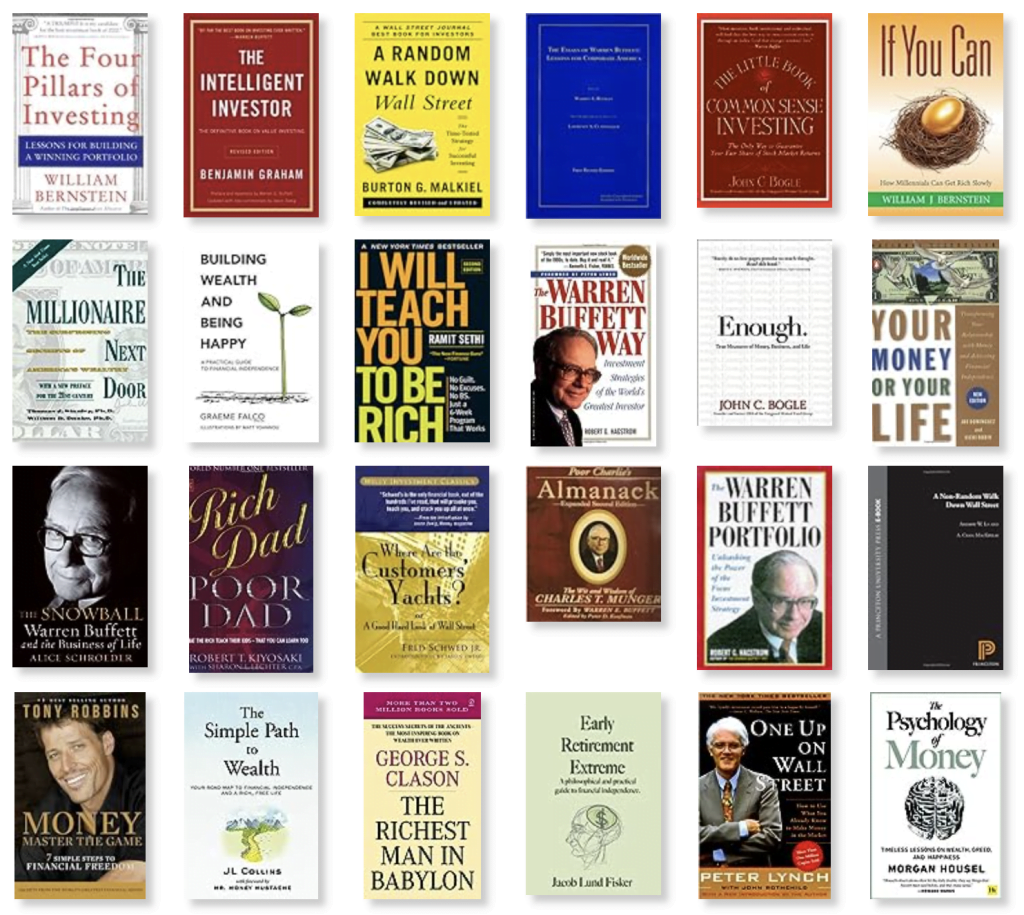

My Goodreads shelf

I’ve read a bunch of other books related to personal finance, investing, and psychology. You can find them in my Finance with Mark shelf on Goodreads. If you’re like any recommendations, please get in touch.