A stock market crash is coming. Your investments are going to drop by 30%. How will you handle it? Let’s pretend the stock market starts crashing today and find out.

How much do you have invested in the stock market today? Imagine those investments start dropping today, December 2023, no preparation time included. They start dropping, and they continue to decline. Your company stock starts dropping. Talks of layoffs start happening. The negative slide continues, extending over the next six months, your investments have fallen 16%, it’s now May, 2024.

People are on edge. And your investments continue to drop. Mass layoffs start occurring across your industry. A year has passed. Your investments are down 43%. It’s now December 2024. And your investments keep falling. A second Christmas of horrible investment performance. Banks are failing. People can’t withdraw money from their checking accounts. Stocks fall another 18% over the next two months. It’s now February 2025.

The financial system is close to complete collapse. You’re down 53%, your investments are less than half of what they are today. Many of your friends have been laid off, you think you’re next, confidence in the economy is at an all time low, and there’s no end in sight. You’ve witnessed your investments fall in value for 14 straight months.

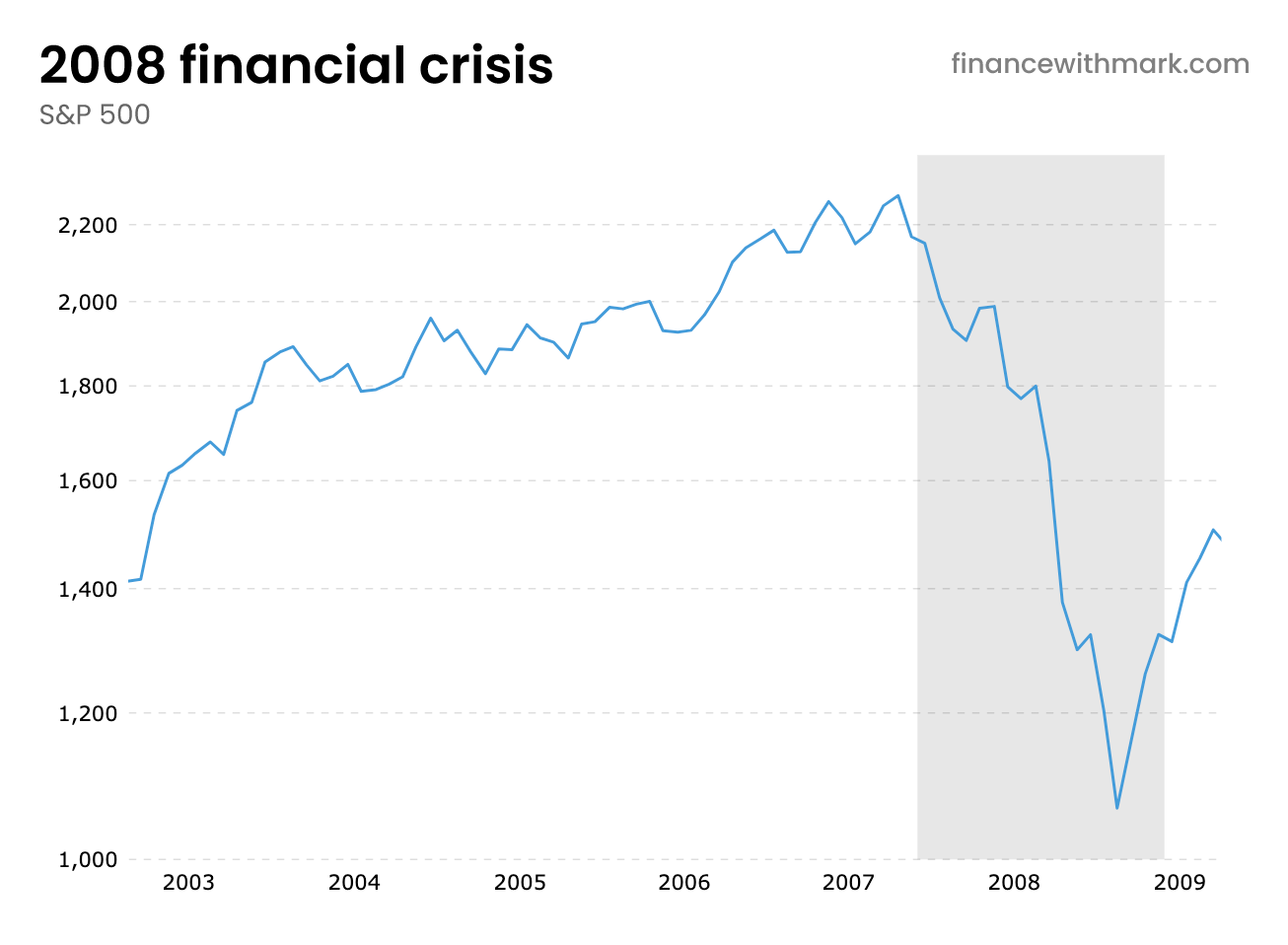

And let’s end the simulation there. Only it wasn’t a simulation, this mirrors the exact timings of the last big crash in 2008, adjusted to start from today. A 14-month period where stocks fell over 50% and directly impacted hundreds of millions of people across the world.

Stocks did start recovering, and four months later the recession was over. But for many in that situation, they thought the worst was still to come, they didn’t feel safe with the stock market ticking up and they were waiting for another drop, they were so impacted by the events of the past 14 months.

How do you think you’d react if you experienced this? You probably land somewhere on this scale.

If you find yourself more insecure, panicked from stocks dropping and layoffs occurring, unsure you wouldn’t let your emotions drive your investing decisions, building a larger emergency fund and holding more money in cash and bonds might be the right move for you. But if you find yourself more secure, aware that these crashes are the price you must pay for long-term stock market returns, resolute to hold your investments without selling, confident enough to invest more while stocks are on sale, then holding closer to 100% in stocks might be the right move for you to improve your long-term returns.

Unfortunately, this is all speculation.

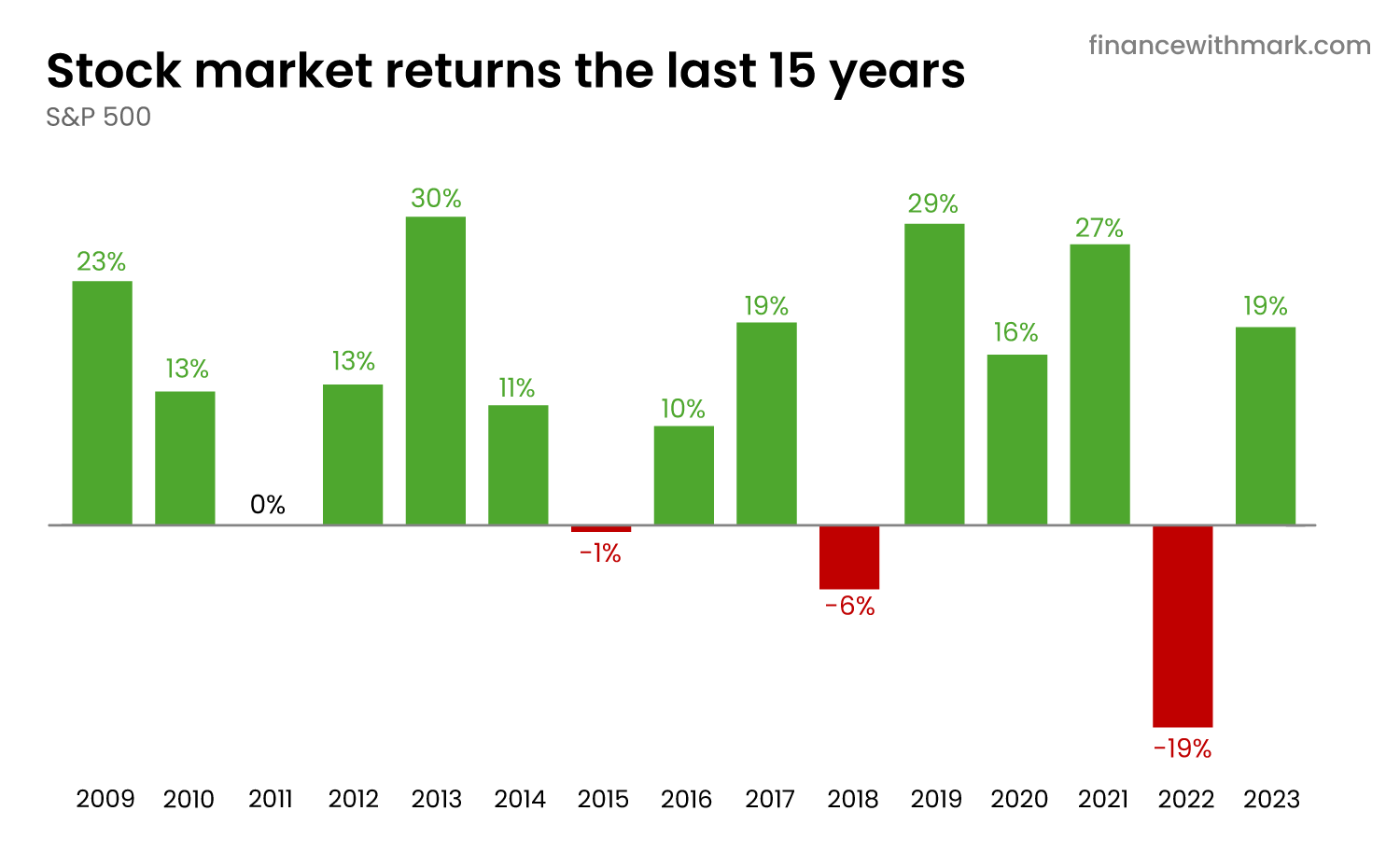

Until we experience a market crash ourselves, we won’t know how we’ll react. And we haven’t experienced a crash in fifteen years.

Other than a quick correction during COVID, we’ve experienced double-digit growth for fifteen years, a 14% return over the past 15 years compared to the all-time 9% average.

We don’t know how we’ll handle the next crash, so how should we act given this?

We should limit our risk until we better understand ourselves. Build a bigger emergency fund than you think you’ll need. Protect yourself from panic selling by investing in your 401k instead of a brokerage account, where there’s more psychological distance and you’re checking the account less frequently.

When I started investing, I took conservative investment decisions. I didn’t pick any individual company stocks, and I didn’t invest 100% in stocks, I invested 20% in bonds to reduce the volatility of my investments. It was a little risk averse for someone with decades of investing ahead of them, but I needed to know I could stomach a market crash. I invested this way for seven years. It was only when I experienced the 30% drop from COVID April 2020 and had the conviction to buy into this drop and invest an extra $10k that I saw I was comfortable with the market dropping and could remove my emotions from the process. This investment gained 50% in the following six months, but I knew I was comfortable seeing it drop too. Now I buy 100% stocks instead of the 80/20 stock/bond split I had before, informed by my actions.

“The only source of knowledge is experience”

Albert Einstein

Build a safety net into your investment decisions and pay attention when the next market crash comes. Learn how you react and adjust your plan accordingly. We’ll experience something like seven market crashes over our lifetime. It’s not our response to the next crash that matters, it’s our response to the rest.