Your 401(k). The account where you can save the most money in a tax free way, letting you grow your net worth as effectively as possible.

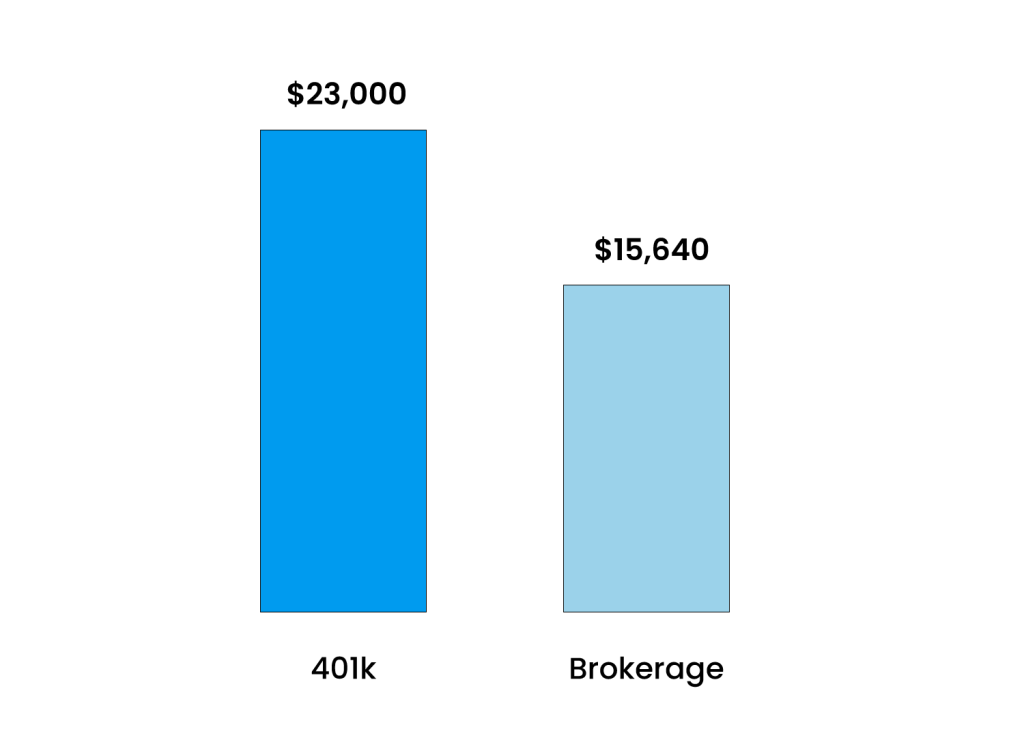

Investing in a tax advantaged way has a huge impact. Take the decision to invest money in your 401(k) or your brokerage account.

You can invest money before it’s taxed in a 401(k), but you can only invest money after it’s taxed in a Brokerage account. If your marginal tax rate1How much your last dollar is taxed (link) is 32%, that means you’ll have invested almost 50% more money if you invest it before you’re taxed than afterwards.

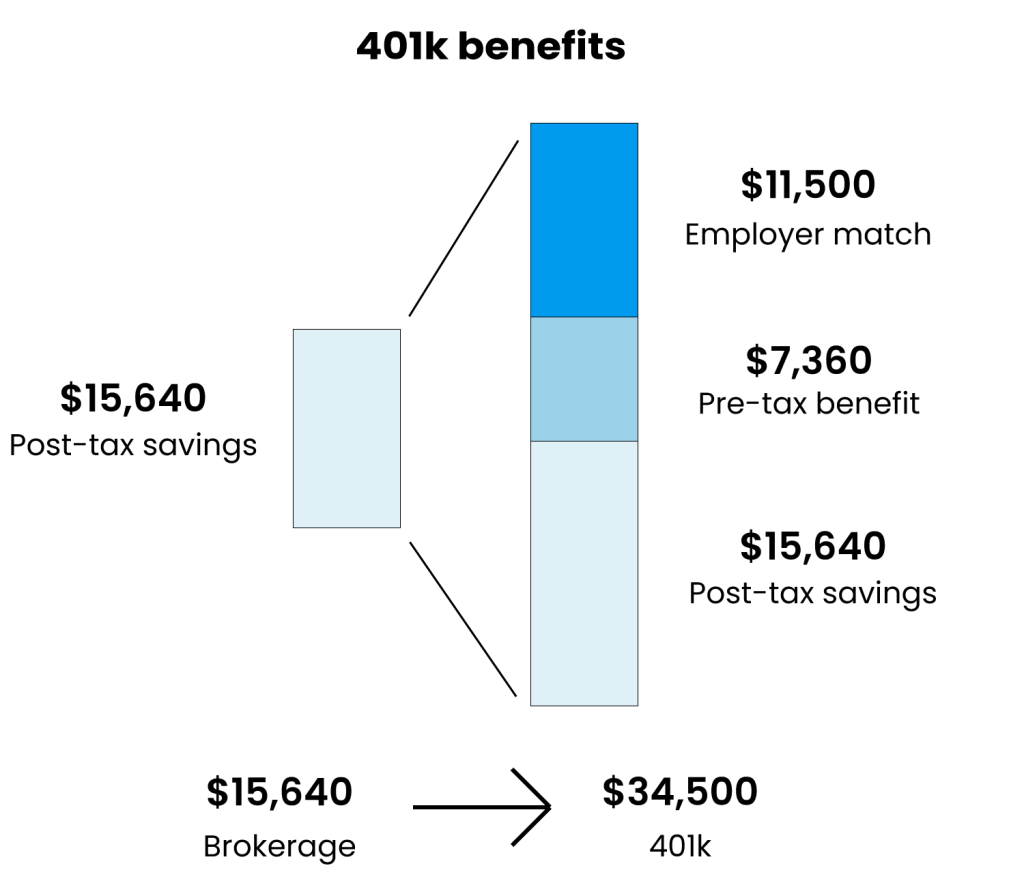

This is before considering that investments in your 401(k) grow tax free, but investments in your brokerage are taxed every year (that’s right!), causing you to lose 15% of the gains you make every year to taxes if you’re choosing a brokerage account instead of your 401(k).

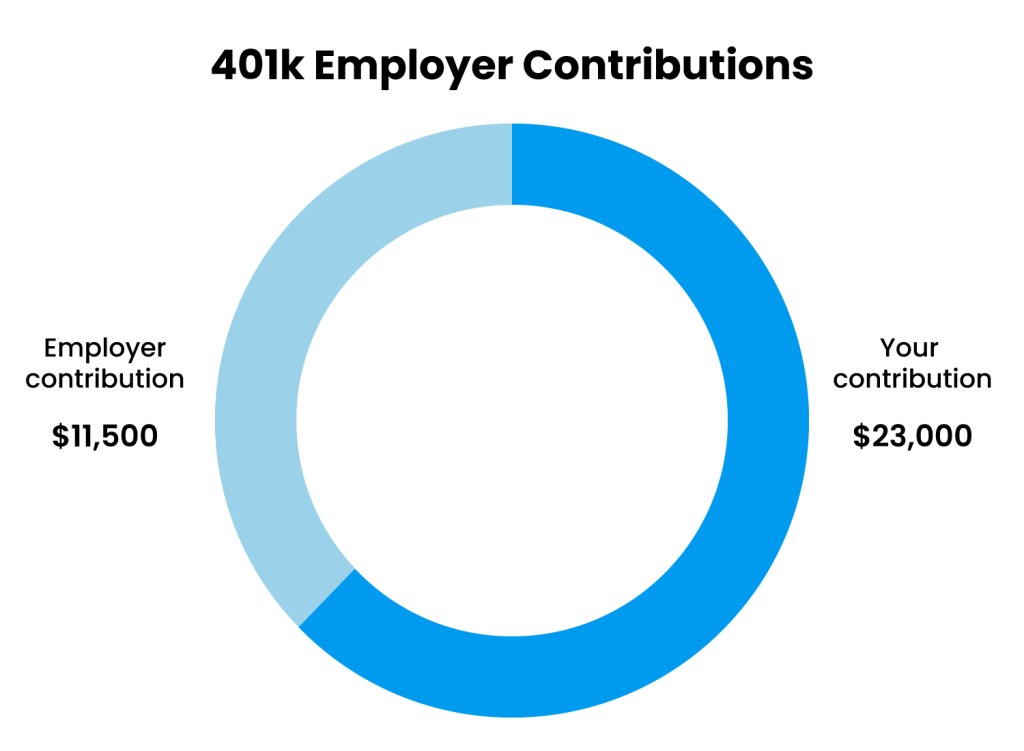

401(k)’s also provide matches from your employer, where you can get an extra $11,500 tax free.

Add these benefits up and investing in your 401(k)’s is clearly better than investing in your brokerage account.

What would be a $15,640 investment in your brokerage account becomes $34,500 when invested in your 401(k), due to avoiding your marginal tax rate and getting an employer match.

But what if I need the money before retirement?

I’m glad you’re bringing this up. The big downside of the 401(k) is you can’t access the money until age 59.5, meaning this money is only available retirement, and not even early retirement at that. It’s a very valid concern and one we can’t just skip over.

Except this isn’t true.

There are actually several ways to access funds in your 401(k) before age 59.5, all legal, well recognized, and unlikely to go away, here’s just a few:

- Roth Conversion Ladder – Access money from your 401(k) with a five year delay by rolling over your 401(k) to a Traditional IRA and then converting to a Roth IRA.

- Mega Backdoor Roth – Contribute after-tax dollars to your 401(k), then convert these contributions to a Roth IRA, enabling you to access these contributions five years after you first convert them.

- SEPP 72(t) (Substantially Equal Periodic Payments) – Define a set payment schedule, e.g. $50k a year, withdraw this fixed amount every year until you reach age 59.5 and you won’t incur penalties.

- Penalty – Simply taking the 10% penalty. While we all want to avoid penalties, due to the significant tax advantages of the 401(k), taking the penalty can actually outperform other investment choices.

- Exceptions – You can use 401(k) funds to cover medical expenses, higher education costs, and the purchase of a first home without incurring penalties (although income taxes may still apply).

There’s plenty more details to go into, so I’ve written a whole article on how to access your 401(k) funds early: Accessing your 401(k) early.

Please check it out to familiarize yourself with your options. Just know that many people completely max out their 401(k) with the plan to access these funds earlier in their 50’s or perhaps even in their 40’s if they need to.