If your company gave you a cash bonus, would you use that cash to buy company stock?

No? Then you should sell your RSU as soon as you receive it.

This is because RSU is just another form of compensation. And if you don’t buy company stock with cash, there’s no reason you shouldn’t immediately sell the company stock to have cash instead, that you can then invest following the flowchart.

So sell your RSUs as soon as you get them. End of post right?

Wrong! Plenty of tech employees are still holding stock from previous RSUs. What do you do with these existing RSUs? They could have significant capital gains that you don’t want to realize.

Well you should still sell and invest it in index funds instead.

But there’s a few nuances to minimize taxes:

Consider holding – #1

Firstly, consider holding the stock until it becomes long-term capital gains.

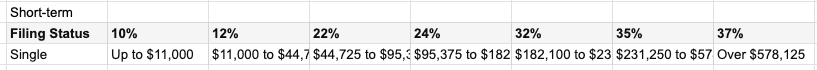

When you sell, if you’ve held for less than a year, you owe short-term capital gains taxes.

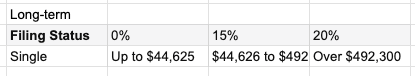

If you’ve held for more than a year, you owe long-term capital gains taxes.

If your company stock is relatively stable, you could save 9% in taxes.

Consider holding – #2

Secondly, consider delaying selling if you know you’re going to earn less income in future.

If you are planning a career break and know you’ll have a lower income next tax year, by all means take advantage of that and wait to sell until when your income is lower. But otherwise, sell immediately, because time in the market beats timing the market.