I optimized for financial independence from my first day at Microsoft, my first paycheck was half of what my colleagues got because I was already maxing out my pension contributions.

Saving came naturally, but it went beyond an innate drive.

When I was 14, my Dad was forced into long-term sick leave. Unable to continue working, he dropped to a partial salary after six months, and eventually no salary at all, we were down to my Mum’s income as a teacher. Fortunately, my parents had saved for a rainy day and we had enough to keep our family afloat, and my Dad’s health eventually recovered, he started two businesses that brought in more than any salary he’d earned before. I was so proud of the grit he showed. But this experience ingrained the importance of money for me, the power of a safety net, and I wanted financial security for myself more than anything so I was never forced to work to illness, never put in a compromised position without options.

I saw the importance of money and welcomed it into my life.

Mr Money became my sidekick to protect me from whatever life might throw my way.

As a teenager, there wasn’t much I could do to materially improve my finances. I focused on doing well at school and getting good work experience. When my parents handed over the money they’d invested for me from birthdays and family gifts, instead of spending some of it on PlayStation games and clothes, I invested it all in a high-interest savings account instead. It wasn’t until a few months before graduation that I had my first real opportunity to make a big difference towards financial security.

I was graduating from Computer Science and had two job offers:

(1) Go back to the start-up I’d interned at as their first Product Manager.

(2) Join Microsoft as a Product Manager on a well-defined career path.

Microsoft would give me mentoring, structure and credibility. It also paid double what the start-up was offering. This was what mattered most to me. It would enable me to invest early in my career, one of the biggest factors for financial success. I decided to sign with Microsoft. I started on the path to financial freedom. Mr Money rejoiced, and I felt more secure.

Microsoft gave me amazing opportunities. I worked with incredible colleagues and learned how to build products used by millions of people. I also found a path to relocate to the US and learned that US salaries were double what they were in Europe. My eyes glimmered at another opportunity to supercharge my financial progress, Mr Money eager in anticipation. I set my sights on the US. And fortunately, a couple of years later I had a visa and a job offer in hand and I relocated to Seattle.

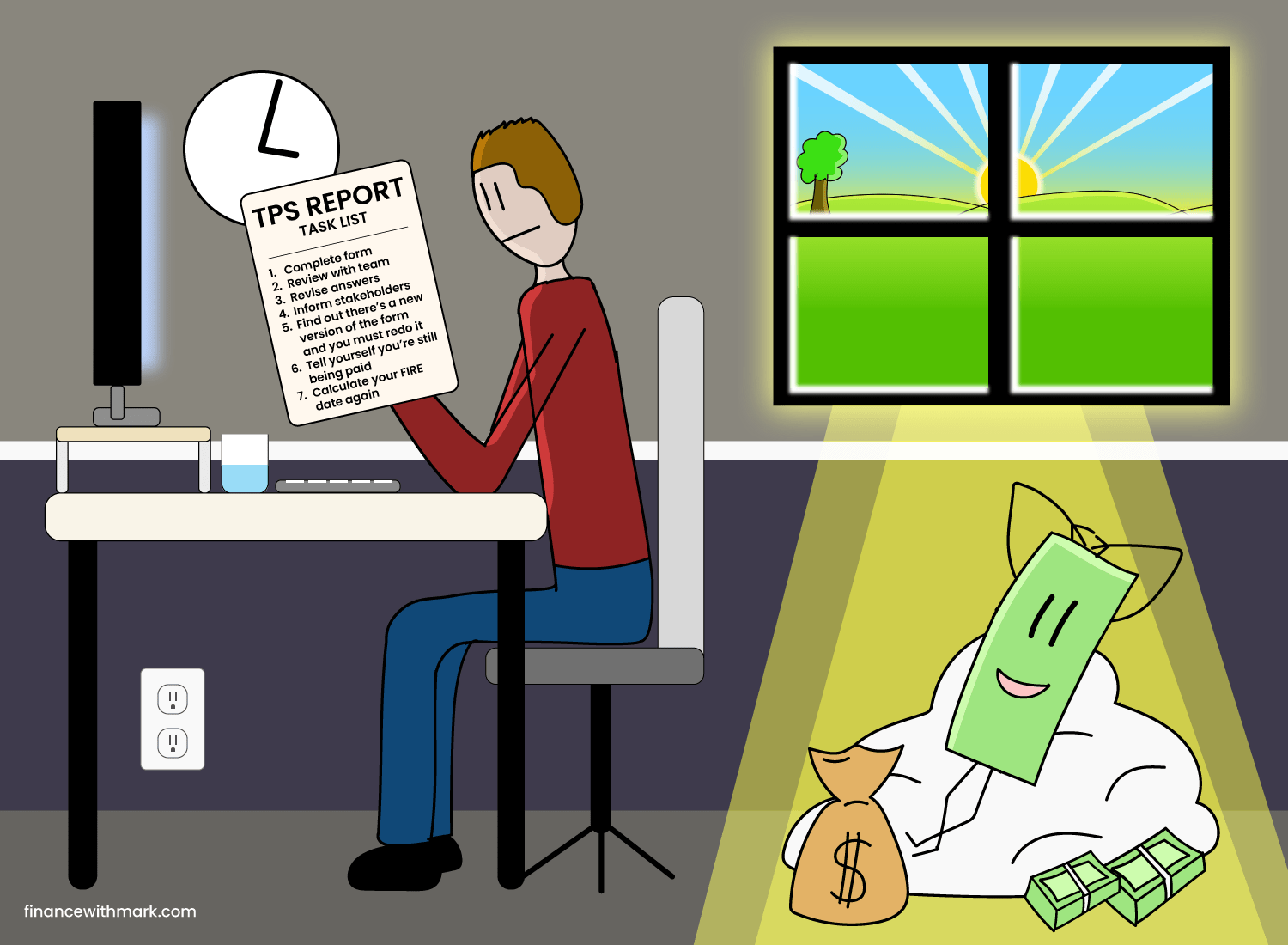

It’d been a few years since graduation at this point and I found myself less passionate about the work. But I told myself this was normal, I had plenty of friends in the same boat. I had great colleagues, an excellent work-life balance, and I was maintaining a high savings rate. I joined a new team and it brought a fresh spark of enthusiasm for work, and my imposter syndrome was slowly disappearing from positive review cycles. But endless meetings, aligning with stakeholders, and managing my emotions as I navigated the corporate machine took a toll on me.

Mr Money comforted me once more. I found myself turning to him ever more frequently to justify my career choices. I would enjoy the freedom he’d buy me one day, but for today, I just had to bury my head in the work.

It wasn’t until Christmas 2022 that it all changed.

I was catching up with university friends over lunch, and one friend was bursting with enthusiasm about his career. He raved about how he was reducing the carbon footprint for car production at his company. He beamed as he shared his team were going to reach net-zero emissions. He was filled with pride about the conferences he’d spoken at, the connections he’d built across the industry, and his team of six he was managing. He loved what he was doing and was completely invested in it. When you witness this level of enthusiasm, you can’t help but be in awe. I know we were all questioning our career choices at that moment.

There are moments that you can’t ignore in life, and this was one of them.

I committed to leaving my job in 2023.

When I got back to work in the new year, I doubled down on my projects. I stretched myself and extended my responsibilities, I even started to grasp at moments of mastery. Mr Money wasn’t on my mind.

I continued working hard and I got a key promotion to Senior Product Manager, “terminal level” where further promotions aren’t required. It was time to move on. But time had flown, I hadn’t started applying to other companies and by now it was already August, just four months from my 2023 deadline. I could easily still be here six months later, still waiting to land the right role.

I started having doubts. Should I stay another 6 months? I could get another 401k match, some extra salary, and more stock awards. Why wasn’t I ready to leave?

I realized the actions I’d taken over the years had shaped my thinking. From taking the corporate job to moving countries, I’d focused on Mr Money. I was seeing the world through a lens of optimizing for finances. When you evaluate every decision through the question of “Will this increase my net worth?”, making a career change doesn’t feel possible.

I realized Mr Money wasn’t serving my needs, I was serving him.

He’d gone from my sidekick to my goal.

I thought back to 14-year-old me who saw Mr Money as the answer to life’s challenges. He was right in some ways. Money can buy options, it can pay for your living expenses to enable a career change. But money can’t reveal your purpose to you. You can find yourself stuck in a job you don’t like if your self-worth comes from your net worth.

“You can use money as a tool to give yourself a better life. Or you can use it as a yardstick for other people to measure you by.”

Morgan Housel

I saw Mr Money as the hammer that could solve all problems and the yardstick that defined my self worth. That’s a lot resting on a little piece of paper.

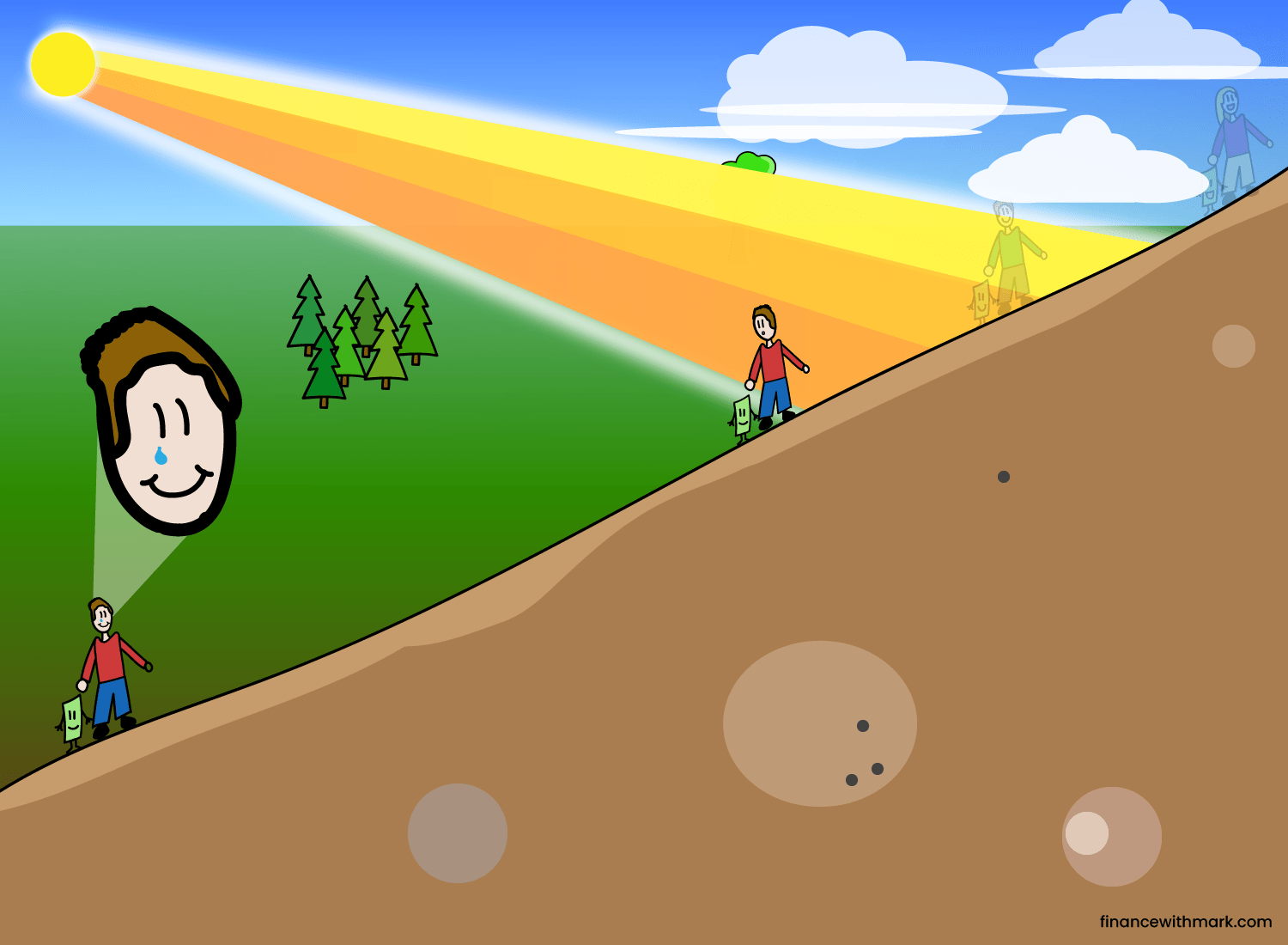

I reflected back on my journey. With Mr Money’s help I’d build an emergency fund, maxed out my 401(k), saved six months of living expenses, then a year. I’d had my head down, always focused on the next milestone. I’d started by comparing myself to classmates in the UK, and now I was comparing myself to tech employees on the west coast. I hadn’t realized how far I’d come. I wasn’t financially independent, there was always more, but my focus over these years had put me in a position of financial stability that I’d only dreamed of. My past self looked up at me, proud.

The end of year deadline was approaching. I couldn’t keep putting Mr Money first, it was time to put myself first. I was ready to embark on my next journey and I felt at peace, knowing I was playing a different game. Without another job lined up, I gave my notice and left Microsoft.

I’d be lying if I didn’t feel doubts and insecurities, but I know this is the right path for me. Mr Money’s still my sidekick, but now he’s just helping out where he can.

Money is never the goal. And when I was reminded of that, I was free to pursue life.

What’s your relationship like with money? How has it changed over time? Is your relationship with money helping you build a better life?

If you’d like to share your thoughts, I’d love to hear them – drop me an email at mark@financewithmark.com