HSA. The Best Financial Account in Existence? A bold claim.

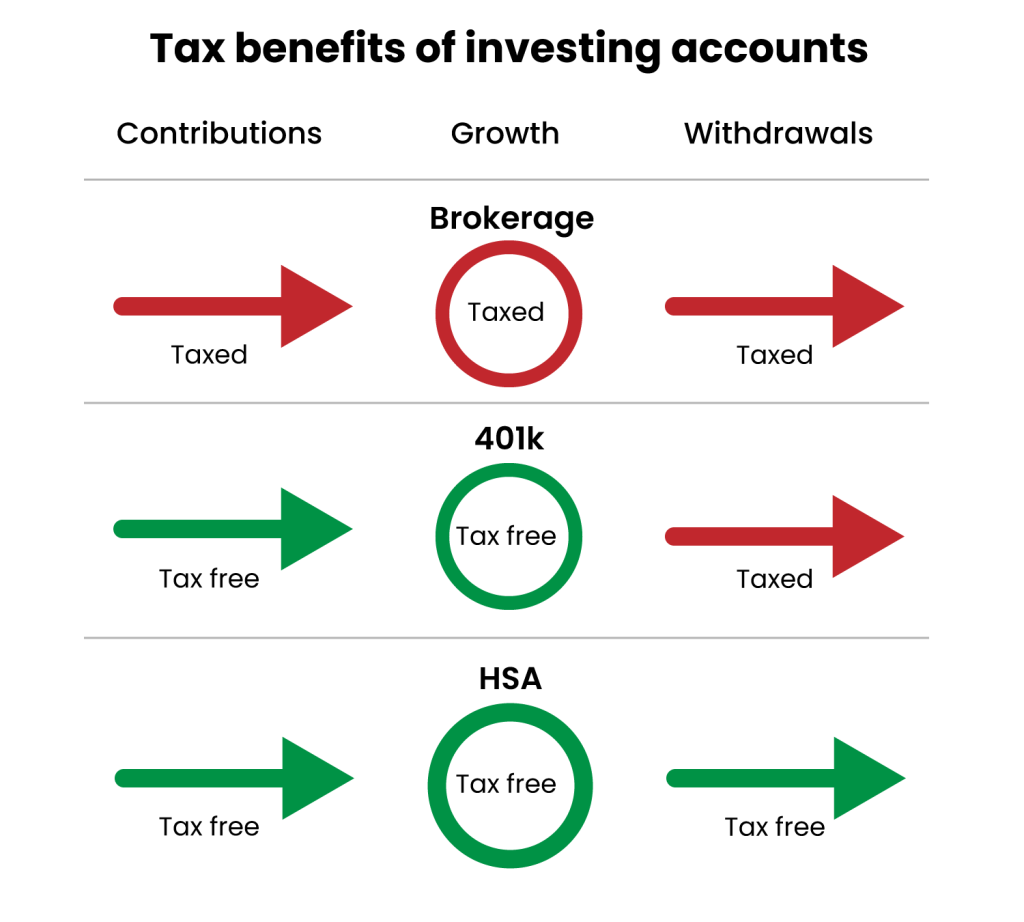

But it’s true. Unlike taxable accounts, Roth IRAs or even 401k’s, you can invest, growth, and withdraw money from an HSA without paying any taxes.

Let me say that again, HSA money isn’t taxed when you contribute, when it grows, or when it’s withdrawn.

The HSA account created by the government to help people who have high-deductible healthcare plans save for the medical expenses they might have from these plans, which is why they provided this magical Triple Tax Benefit of HSA accounts.

HSA funds can be invested, which makes them the best account to compound your savings.

For withdrawing from HSA’s you have two options. Firstly, you can withdraw from HSA’s for medical expenses at any time without penalty. Secondly, if you don’t have medical expenses or simply want to let the compounding continue, you can withdraw after age 65 for any expenses.

Considerations

Make sure a HDHP makes sense for you.

{Image: injured person, wishing they’d not entered high deductable plan}

Track medical receipts

{Image: How much money would you like?}

Notes:

- When you contribute to an HSA via a payroll deduction, you can avoid paying FICA taxes (Social Security and Medicare), saving you 7.65% – that’s an additional $558 of tax savings per year.

- Track your medical receipts so you know how much you’re able to withdraw from your HSA, as you can withdraw at any time for qualifying expenses. You could withdraw $5k aged 50 for a surgery you had aged 25 if you save the receipts.